CASE STUDY 1

A GP fails to raise a Fund 3 because an anchor investor requires cash distributions.

This document is for illustrative purposes only and does not constitute financial or legal advice. The case study presented is a hypothetical and simplified illustration of a complex financial instrument. It is not intended to be representative of all situations and should not be relied upon for investment decisions.

A GP fails to raise a Fund 3 because an anchor investor requires cash distributions. VC financing for a specific LP.

This document is for illustrative purposes only and does not constitute financial or legal advice. The case study presented is a hypothetical and simplified illustration of a complex financial instrument. It is not intended to be representative of all situations and should not be relied upon for investment decisions.

Alpha Fund 3 is without an anchor LP

An investment firm called Alpha Venture (AV) has an LP called InvestCorp. InvestCorp aims to anchor AV’s Fund 3, referred to as AF3 (Alpha Fund 3).

While InvestCorp was previously a reliable anchor in every AV fund, the problem now is that InvestCorp has a new chairperson who has announced that their corporate VC program must now be self-sustaining.

For AV, this means that there is no immediate cash for InvestCorp to commit to AF3. An InvestCorp LP check can now only be funded from prior fund cash distributions.

All of AV’s other prospective AF3 LPs require InvestCorp’s anchor check to participate and ensure sufficient AF3 LP capital to avoid breaching fund concentration limits.

Further, an AF3 anchor check can be used immediately to fund a time-sensitive pipeline of deals (enticing more prospective AF3 LPs).

The AV team is frustrated as a key portfolio company in AF1 called “Company D” is about to begin an IPO process and the investment team expect a significant liquidity event within 18 months.

AV has no choice but to delay Fund 3 from December 2024 until the Company D exit is completed in 18 months. They downsize the team, withhold bonuses, and, importantly, lose momentum in their Fund 3 raise. Potential investors lose interest and deploy capital elsewhere.

An investment firm called Alpha Venture (AV) has an LP called InvestCorp. InvestCorp aims to anchor AV’s Fund 3, referred to as AF3 (Alpha Fund 3).

While InvestCorp was previously a reliable anchor in every AV fund, the problem now is that InvestCorp has a new chairperson who has announced that their corporate VC program must now be self-sustaining.

For AV, this means that there is no immediate cash for InvestCorp to commit to AF3. An InvestCorp LP check can now only be funded from prior fund cash distributions.

All of AV’s other prospective AF3 LPs require InvestCorp’s anchor check to participate and ensure sufficient AF3 LP capital to avoid breaching fund concentration limits.

Further, an AF3 anchor check can be used immediately to fund a time-sensitive pipeline of deals (enticing more prospective AF3 LPs).

The AV team is frustrated as a key portfolio company in AF1 called “Company D” is about to begin an IPO process and the investment team expect a significant liquidity event within 18 months.

AV has no choice but to delay Fund 3 from December 2024 until the Company D exit is completed in 18 months. They downsize the team, withhold bonuses, and, importantly, lose momentum in their Fund 3 raise. Potential investors lose interest and deploy capital elsewhere.

If the GP had reached out to Nodem, this scenario could have been managed in a completely different way. The GP could have launched AF3 as planned and continued operations smoothly.

If the GP had reached out to Nodem, this scenario could have been managed in a completely different way. The GP could have launched AF3 as planned and continued operations smoothly.

InvestCorp’s decision-making framework

Alpha Fund 3 is without an anchor LP

An anchor LP is unable to invest in Alpha Venture’s Fund 3

An anchor LP is unable to invest in Alpha Venture’s Fund 3

Alpha Venture’s (AV) corporate anchor LP (InvestCorp) can only anchor Alpha Fund 3 (AF3) from cash distributions from their prior AV fund LP investments.

InvestCorp has two LP positions in prior AV funds:

A 2018 vintage VC Fund (Alpha Fund 1 – AF1): InvestCorp committed $40m to AF1. InvestCorp’s specific share of LP NAV is currently $167.9m.

A 2022 vintage VC Fund (Alpha Fund 2 – AF2): InvestCorp committed $50m to AF2. InvestCorp’s specific share of LP NAV is currently $60m.

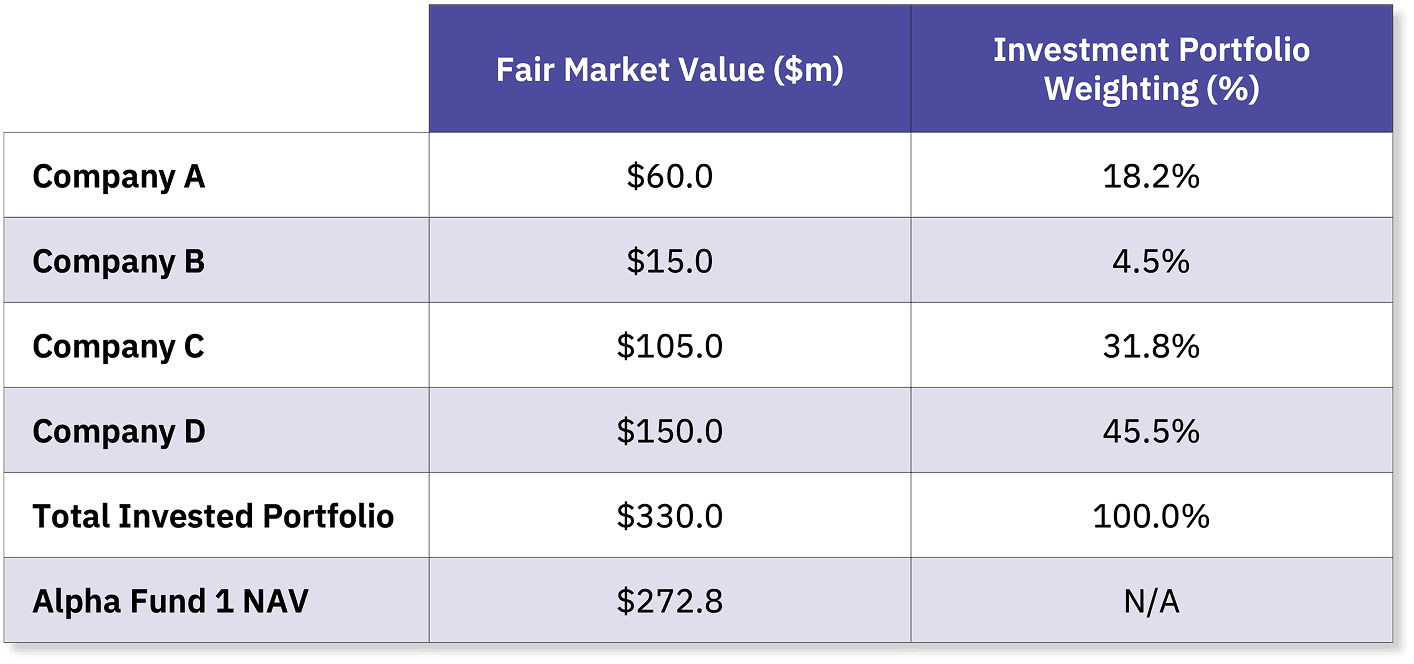

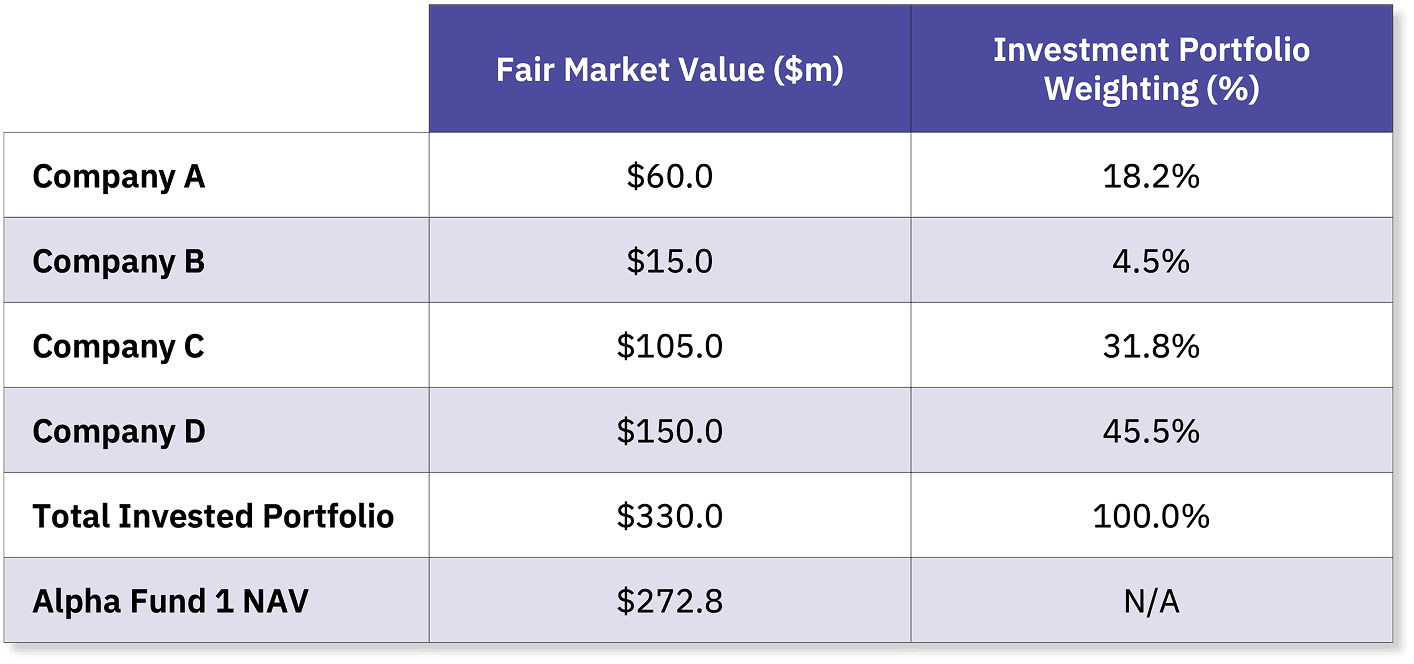

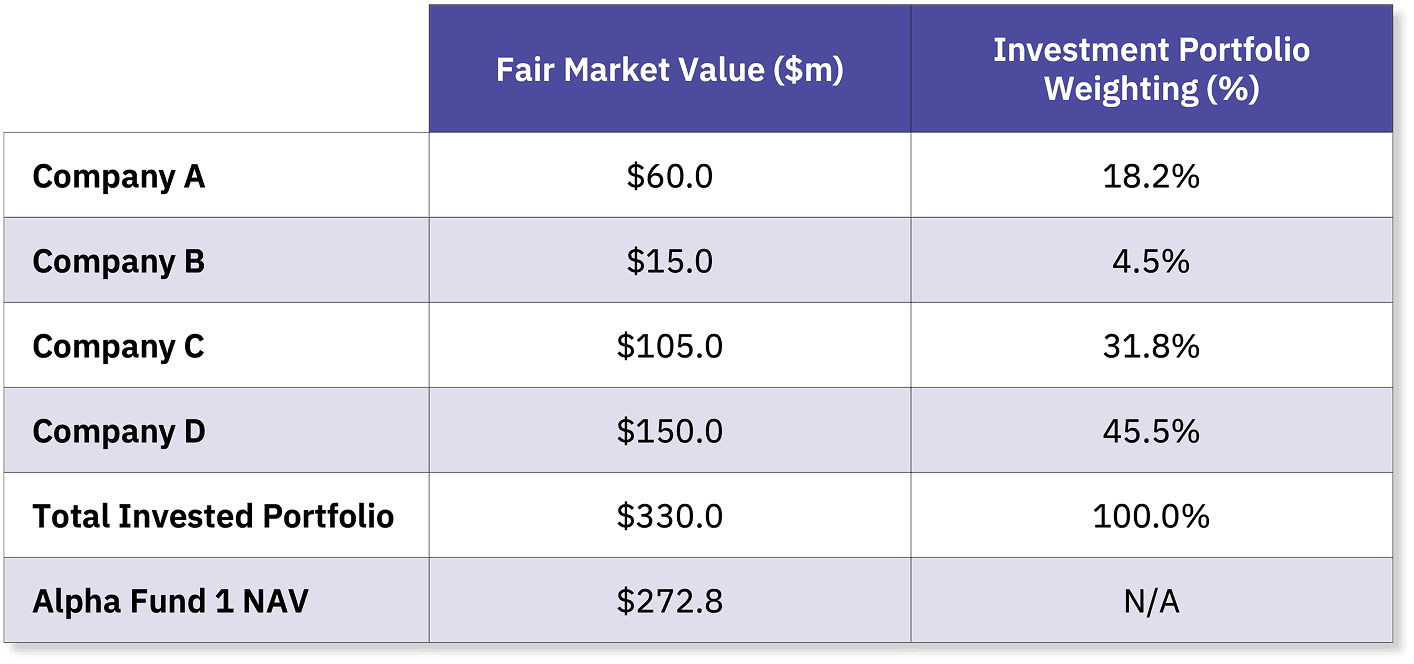

Alpha Fund 1: Total Portfolio & NAV

Alpha Venture’s (AV) corporate anchor LP (InvestCorp) can only anchor Alpha Fund 3 (AF3) from cash distributions from their prior AV fund LP investments.

InvestCorp has two LP positions in prior AV funds:

A 2018 vintage VC Fund (Alpha Fund 1 – AF1): InvestCorp committed $40m to AF1. InvestCorp’s specific share of LP NAV is currently $167.9m.

A 2022 vintage VC Fund (Alpha Fund 2 – AF2): InvestCorp committed $50m to AF2. InvestCorp’s specific share of LP NAV is currently $60m.

Alpha Fund 1: Total Portfolio & NAV

– InvestCorp’s specific LP interest in Alpha Fund 1

– InvestCorp’s Original AF1 Commitment: $40m

– InvestCorp’s Share of Total NAV: 61.5% (calculated as its $40m commitment divided by total fund commitments of $65m).

– The current value of InvestCorp’s AF1 LP stake: $167.9m

– InvestCorp’s specific LP interest in Alpha Fund 1

– InvestCorp’s Original AF1 Commitment: $40m

– InvestCorp’s Share of Total NAV: 61.5% (calculated as its $40m commitment divided by total fund commitments of $65m).

– The current value of InvestCorp’s AF1 LP stake: $167.9m

An anchor LP is unable to invest in Alpha Venture’s Fund 3

Waiting for Company D’s impending exit

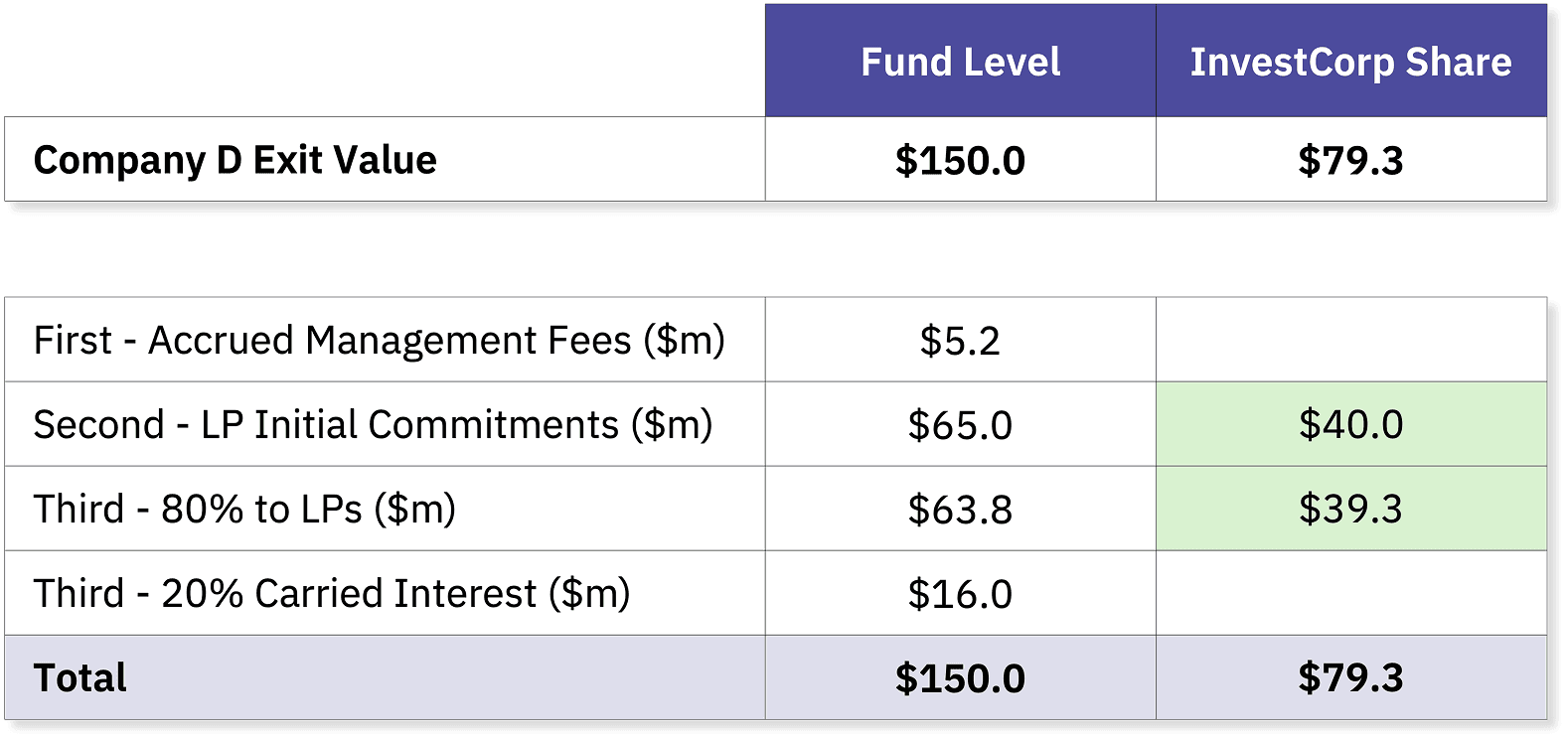

The AV team has high conviction that AF1’s core portfolio company, Company D, will be sold (in a cash sale) to a strategic acquirer within 18 months.

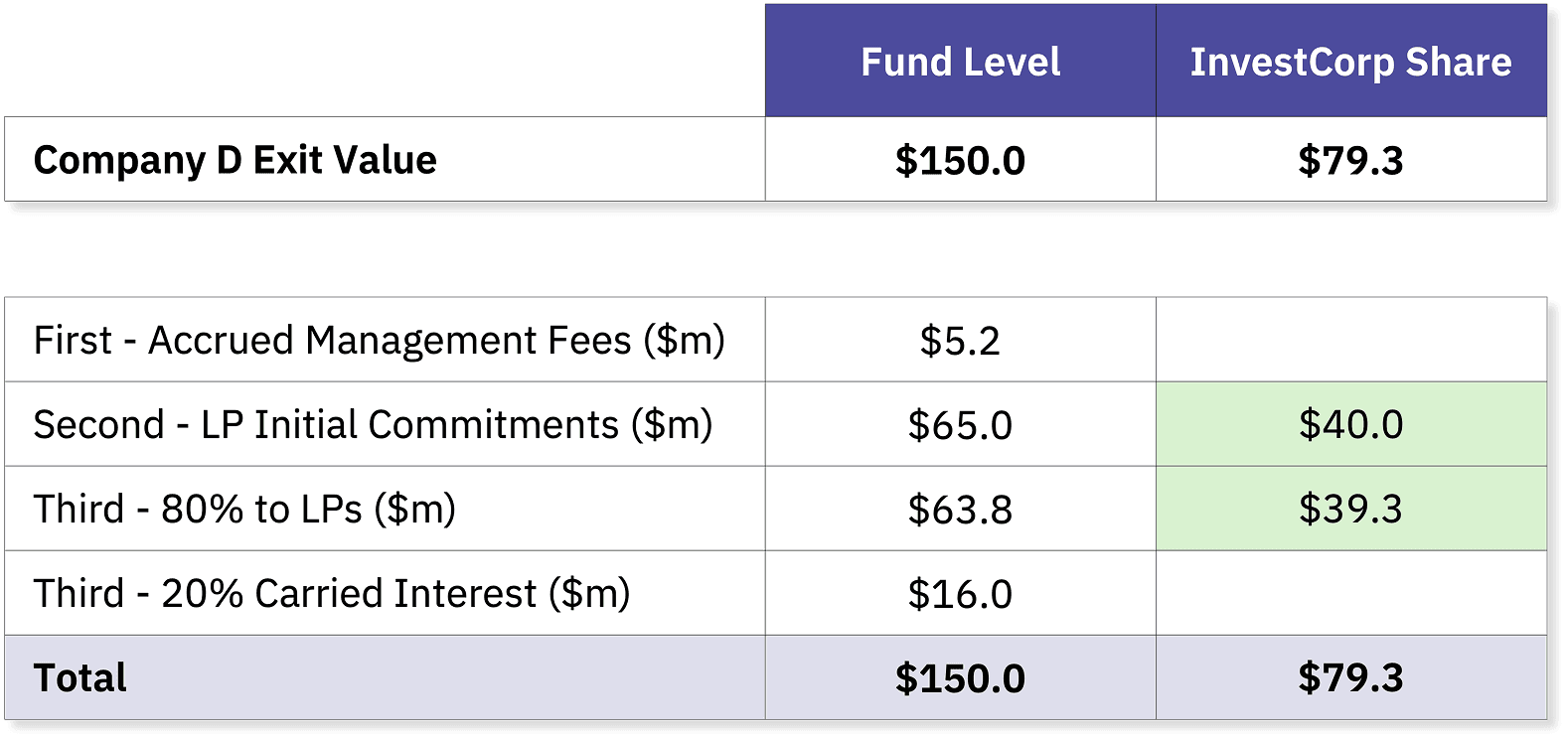

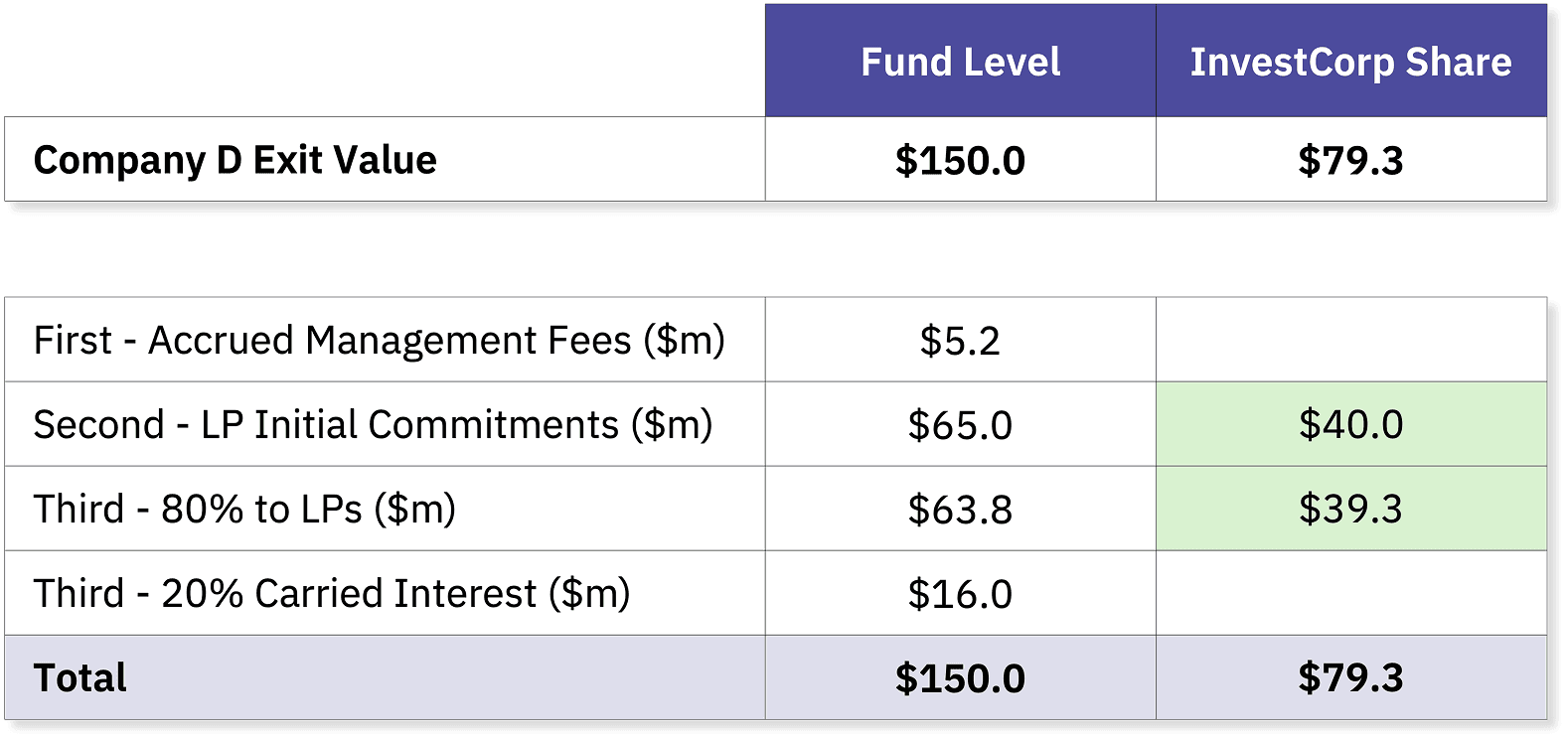

When Company D is sold, AF1 should receive cash proceeds of at least $150m, which will flow through the fund’s waterfall in the following ranking.

The AV team has high conviction that AF1’s core portfolio company, Company D, will be sold (in a cash sale) to a strategic acquirer within 18 months.

When Company D is sold, AF1 should receive cash proceeds of at least $150m, which will flow through the fund’s waterfall in the following ranking.

InvestCorp and the AV team can see that the cash inflows should be sufficient to repay a NAV facility with a significant margin of safety.

InvestCorp and the AV team can see that the cash inflows should be sufficient to repay a NAV facility with a significant margin of safety.

Waiting for Company D’s impending exit

NAV financing to address InvestCorp’s cash flow situation.

AV’s first call is to a variety of banks to understand the terms of a potential loan. The first bank quickly rejects a facility based on the collateral being a concentrated basket of VC-backed assets. The second bank makes a tentative offer, but it has a strict 12-month duration and requires cash interest payments. This is unacceptable as InvestCorp has no cash to pay the interest, and the Company D exit date is uncertain.

Alpha Venture’s CFO calls Nodem to explain the situation with Fund 3. The CFO is coordinating with InvestCorp’s investment team to find a solution. AV’s CFO, Nodem, and InvestCorp arrange a call to decide how best to accelerate AF1 distributions such that they can be used to anchor AF3.

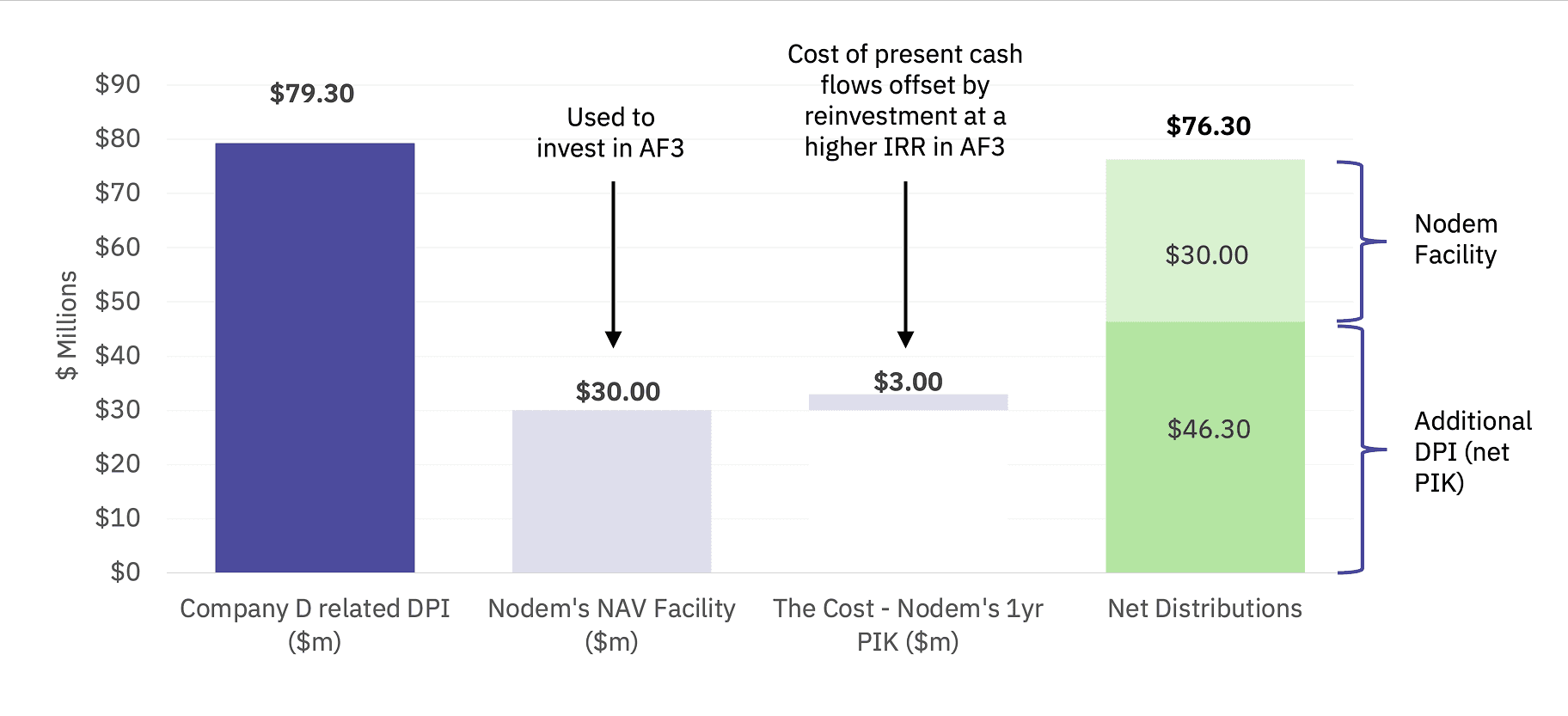

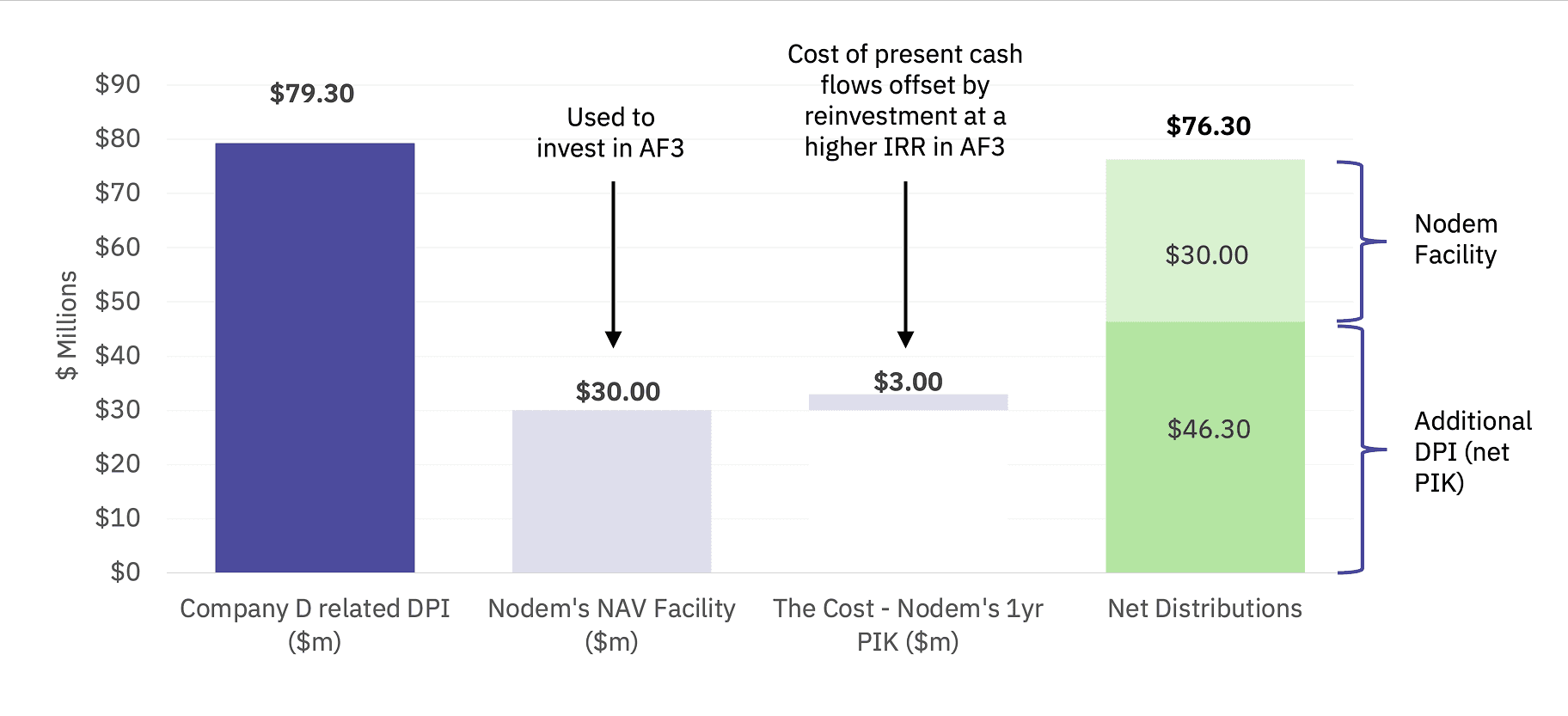

InvestCorp decides that a $30m Nodem NAV facility would be an appropriate facility size. Nodem’s PIK interest offer is deemed acceptable, and there is no strict term limit should the Company D exit be delayed.

This $30m NAV facility to InvestCorp would secure their LP stake, currently worth $167.9m (NAV) – a 17.9% LTV NAV facility. With up to $79.3m expected from the Company D distribution alone, this provides a significant margin of safety and more precise facility repayment timing.

AV’s first call is to a variety of banks to understand the terms of a potential loan. The first bank quickly rejects a facility based on the collateral being a concentrated basket of VC-backed assets. The second bank makes a tentative offer, but it has a strict 12-month duration and requires cash interest payments. This is unacceptable as InvestCorp has no cash to pay the interest, and the Company D exit date is uncertain.

Alpha Venture’s CFO calls Nodem to explain the situation with Fund 3. The CFO is coordinating with InvestCorp’s investment team to find a solution. AV’s CFO, Nodem, and InvestCorp arrange a call to decide how best to accelerate AF1 distributions such that they can be used to anchor AF3.

InvestCorp decides that a $30m Nodem NAV facility would be an appropriate facility size. Nodem’s PIK interest offer is deemed acceptable, and there is no strict term limit should the Company D exit be delayed.

This $30m NAV facility to InvestCorp would secure their LP stake, currently worth $167.9m (NAV) – a 17.9% LTV NAV facility. With up to $79.3m expected from the Company D distribution alone, this provides a significant margin of safety and more precise facility repayment timing.

NAV financing to address InvestCorp’s cash flow situation.

NAV financing: Mechanics and cost

For Nodem’s security, InvestCorp transfers its AF1 LP stake into a new SPV. The $30m NAV facility is offered against this SPV. Practically, InvestCorp is still the LP, and other AF1 LPs are unaffected.

In the example below, Nodem’s $30m NAV facility is disbursed on 31st December 2024. This capital secures AF3’s first close and is drawn immediately by AV to fund a portfolio of time-sensitive new investments.

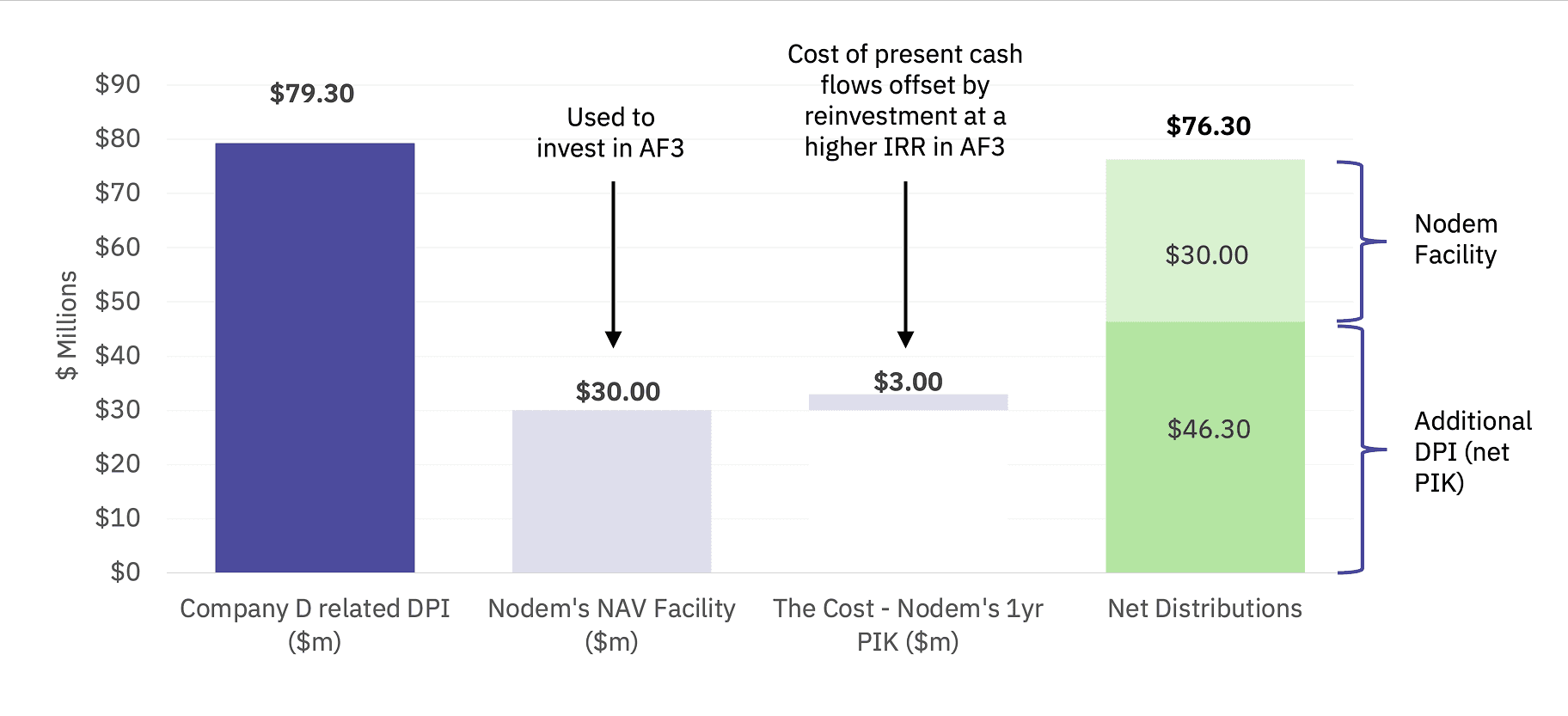

For the purposes of this illustration, Nodem’s NAV facility is outstanding for one year, until 31st December 2025, when the AF1 receives Company D exit proceeds (6 months earlier than the 18 months expected). InvestCorp’s AF1 LP distributions are $79.3m, which comfortably repays Nodem’s NAV facility and outstanding PIK balance.

For Nodem’s security, InvestCorp transfers its AF1 LP stake into a new SPV. The $30m NAV facility is offered against this SPV. Practically, InvestCorp is still the LP, and other AF1 LPs are unaffected.

In the example below, Nodem’s $30m NAV facility is disbursed on 31st December 2024. This capital secures AF3’s first close and is drawn immediately by AV to fund a portfolio of time-sensitive new investments.

For the purposes of this illustration, Nodem’s NAV facility is outstanding for one year, until 31st December 2025, when the AF1 receives Company D exit proceeds (6 months earlier than the 18 months expected). InvestCorp’s AF1 LP distributions are $79.3m, which comfortably repays Nodem’s NAV facility and outstanding PIK balance.

For the NAV facility’s present cash flows, a new waterfall is created for InvestCorp’s AF1 LP position.

For the NAV facility’s present cash flows, a new waterfall is created for InvestCorp’s AF1 LP position.

For the NAV facility’s present cash flows, a new waterfall is created for InvestCorp’s AF1 LP position.

First: InvestCorp receives $30m from Nodem (the NAV facility)

Second: Nodem must be repaid the $30m from subsequent LP flows.

Third: Nodem’s outstanding balance (PIK) is repaid

Fourth: All future proceeds to InvestCorp.

First: InvestCorp receives $30m from Nodem (the NAV facility)

Second: Nodem must be repaid the $30m from subsequent LP flows.

Third: Nodem’s outstanding balance (PIK) is repaid

Fourth: All future proceeds to InvestCorp.

Importantly, Investcorp did not sell its LP (likely at a discount). InvestCorp was able to utilize the NAV facility to take liquidity without giving away the prospect of further upside

Importantly, the cost of the NAV facility can be offset by the value of present cash flows, which are re-invested in AF3 (which plans on generating an IRR of +20%).

Importantly, Investcorp did not sell its LP (likely at a discount). InvestCorp was able to utilize the NAV facility to take liquidity without giving away the prospect of further upside

Importantly, the cost of the NAV facility can be offset by the value of present cash flows, which are re-invested in AF3 (which plans on generating an IRR of +20%).

What are the costs and risks for InvestCorp and the GP?

Nodem is reimbursed 12 months after the initial $30m disbursement. The reimbursement is made from the liquidity the team receives from the sale of Company D.

If there were delays in distribution, the outstanding balance would continue to accrue interest at the given interest rate. If the ultimate value of Company D were zero, then Nodem would have a senior claim on the residual value until the NAV facility balance is repaid.

What are the costs and risks for InvestCorp and the GP?

Nodem is reimbursed 12 months after the initial $30m disbursement. The reimbursement is made from the liquidity the team receives from the sale of Company D.

If there were delays in distribution, the outstanding balance would continue to accrue interest at the given interest rate. If the ultimate value of Company D were zero, then Nodem would have a senior claim on the residual value until the NAV facility balance is repaid.

NAV financing: Mechanics and cost

Related case studies

GPs & Funds

Participate in play to play round

GPs & Funds

Bridge an LP anchor commit

Family Offices

Fuelling Investment Holding Company Growth with a NAV Facility

Family Offices

Wealth Transfer

Family Offices

Refinancing with a PIK-based facility

GPs & Funds

Unlock accrued fees

Family Offices

Unlock capital without selling growing private assets

Family Offices

Rebalance Portfolio

Family Offices

Bridging Capital Calls

Related case studies

GPs & Funds

Participate in play to play round

GPs & Funds

Bridge an LP anchor commit

Family Offices

Fuelling Investment Holding Company Growth with a NAV Facility

Family Offices

Wealth Transfer

Family Offices

Refinancing with a PIK-based facility

GPs & Funds

Unlock accrued fees

Family Offices

Unlock capital without selling growing private assets

Family Offices

Rebalance Portfolio

Family Offices

Bridging Capital Calls

Related case studies

GPs & Funds

Participate in play to play round

GPs & Funds

Bridge an LP anchor commit

Family Offices

Fuelling Investment Holding Company Growth with a NAV Facility

Family Offices

Wealth Transfer

Family Offices

Refinancing with a PIK-based facility

GPs & Funds

Unlock accrued fees

Family Offices

Unlock capital without selling growing private assets

Family Offices

Rebalance Portfolio

Family Offices

Bridging Capital Calls

Related case studies

GPs & Funds

Participate in play to play round

GPs & Funds

Bridge an LP anchor commit

Family Offices

Fuelling Investment Holding Company Growth with a NAV Facility

Family Offices

Wealth Transfer

Family Offices

Refinancing with a PIK-based facility

GPs & Funds

Unlock accrued fees

Family Offices

Unlock capital without selling growing private assets

Family Offices

Rebalance Portfolio

Family Offices

Bridging Capital Calls

London Office

Nodem Ltd

1a Britannia Street

London

United Kingdom

WC1X 9JT

Nodem Ltd is authorised and regulated by the Financial Conduct Authority, FRN 1017481. Company number 15661530. Nodem Ltd is registered in England and Wales under company number 15661530.

This website is for informational purposes only and does not constitute an offer, solicitation, or recommendation to sell or an offer to purchase any securities, investment products, or investment advisory services. This website and the information set forth herein are current as of 4 June 2025 and are not intended to provide investment recommendations or advice.

London Office

Nodem Ltd

1a Britannia Street

London

United Kingdom

WC1X 9JT

Nodem Ltd is authorised and regulated by the Financial Conduct Authority, FRN 1017481. Company number 15661530. Nodem Ltd is registered in England and Wales under company number 15661530.

This website is for informational purposes only and does not constitute an offer, solicitation, or recommendation to sell or an offer to purchase any securities, investment products, or investment advisory services. This website and the information set forth herein are current as of 4 June 2025 and are not intended to provide investment recommendations or advice.

London Office

Nodem Ltd

1a Britannia Street

London

United Kingdom

WC1X 9JT

Nodem Ltd is authorised and regulated by the Financial Conduct Authority, FRN 1017481. Company number 15661530. Nodem Ltd is registered in England and Wales under company number 15661530.

This website is for informational purposes only and does not constitute an offer, solicitation, or recommendation to sell or an offer to purchase any securities, investment products, or investment advisory services. This website and the information set forth herein are current as of 4 June 2025 and are not intended to provide investment recommendations or advice.