CASE STUDY 1

Downsizing the team due to management company cash flow issues.

This document is for illustrative purposes only and does not constitute financial or legal advice. The case study presented is a hypothetical and simplified illustration of a complex financial instrument. It is not intended to be representative of all situations and should not be relied upon for investment decisions.

CASE STUDY 2

Downsizing the team due to management company cash flow issues.

This document is for illustrative purposes only and does not constitute financial or legal advice. The case study presented is a hypothetical and simplified illustration of a complex financial instrument. It is not intended to be representative of all situations and should not be relied upon for investment decisions.

Cash flow woes at a boutique VC

An investment firm called Alpha Ventures (AV) has an LP called InvestCorp. InvestCorp has withdrawn as the anchor of Fund 3 (Alpha Fund 3) two months ahead of the expected December 2024 first close. AV was caught off guard and was unable to secure replacement LP capital.

It is mid-December 2024, and the message from the CFO to the broader VC team was clear. Unless there are exits or new fund revenues, AV’s management company will run out of money in the next few months.

While AV has over $5m of accrued management fees in Alpha Fund 1 (AF1), the VC firm requires $2m a year of revenue to pay staff and cover other operating expenses.

Bank financing is unavailable as Alpha Fund 3’s (AF3) LPs have not legally committed to the fund yet. AF1, against which financing could be sought, is heavily concentrated in 4 VC assets, a “credit” that banks struggle to underwrite.

The AV team does not want to sell their AF1 LP stake (5% prior GP commit) or carried interest as they will attract steep discounts on positions that have significant (and growing) value.

The situation is frustrating for AV as AF1 expects significant liquidity in the next 24 months from the exit of a key portfolio company (Company D).

Given the news, AV has no choice but to downsize the team, withhold bonuses, and risk serious reputational damage.

An investment firm called Alpha Ventures (AV) has an LP called InvestCorp. InvestCorp has withdrawn as the anchor of Fund 3 (Alpha Fund 3) two months ahead of the expected December 2024 first close. AV was caught off guard and was unable to secure replacement LP capital.

It is mid-December 2024, and the message from the CFO to the broader VC team was clear. Unless there are exits or new fund revenues, AV’s management company will run out of money in the next few months.

While AV has over $5m of accrued management fees in Alpha Fund 1 (AF1), the VC firm requires $2m a year of revenue to pay staff and cover other operating expenses.

Bank financing is unavailable as Alpha Fund 3’s (AF3) LPs have not legally committed to the fund yet. AF1, against which financing could be sought, is heavily concentrated in 4 VC assets, a “credit” that banks struggle to underwrite.

The AV team does not want to sell their AF1 LP stake (5% prior GP commit) or carried interest as they will attract steep discounts on positions that have significant (and growing) value.

The situation is frustrating for AV as AF1 expects significant liquidity in the next 24 months from the exit of a key portfolio company (Company D).

Given the news, AV has no choice but to downsize the team, withhold bonuses, and risk serious reputational damage.

If the GP had reached out to Nodem, this scenario could have been managed in a completely different way. The GP would instead have continued operations smoothly.

If the GP had reached out to Nodem, this scenario could have been managed in a completely different way. The GP would instead have continued operations smoothly.

Alpha Ventures decision-making framework

Alpha Ventures decision-making framework

Cash flow woes at a boutique VC

An anchor LP pulls out of Fund 3 at the last minute

Two months ahead of Alpha Fund 3’s (AF3) first close in late 2024, Alpha Ventures (AV) corporate anchor LP (InvestCorp) pulled out of the fund. InvestCorp gained a new CEO who wanted to halt all new VC fund investments and sell their existing corporate VC book through an intermediary bank-coordinated auction process.

AV has two funds:

2018 vintage VC Fund (Alpha Fund 1 – AF1) with $65m in LP commitments. AF1 is currently valued at $330 million on a fair market basis.

2022 vintage VC Fund (Alpha Fund 2 – AF2) with $100m in LP commitments. AF2 is currently valued at $200 million on a fair market basis.

Accruing management fees is common practice for VC firms, and it is done for two primary reasons:

Reserving cash for management fees reduces investment capital. Maximising investment capital (as a proportion of LP commitments) increases the probability of strong returns (and generating carried interest).

The expectation of cash flows from future funds being sufficient to cover the firm's opex needs.

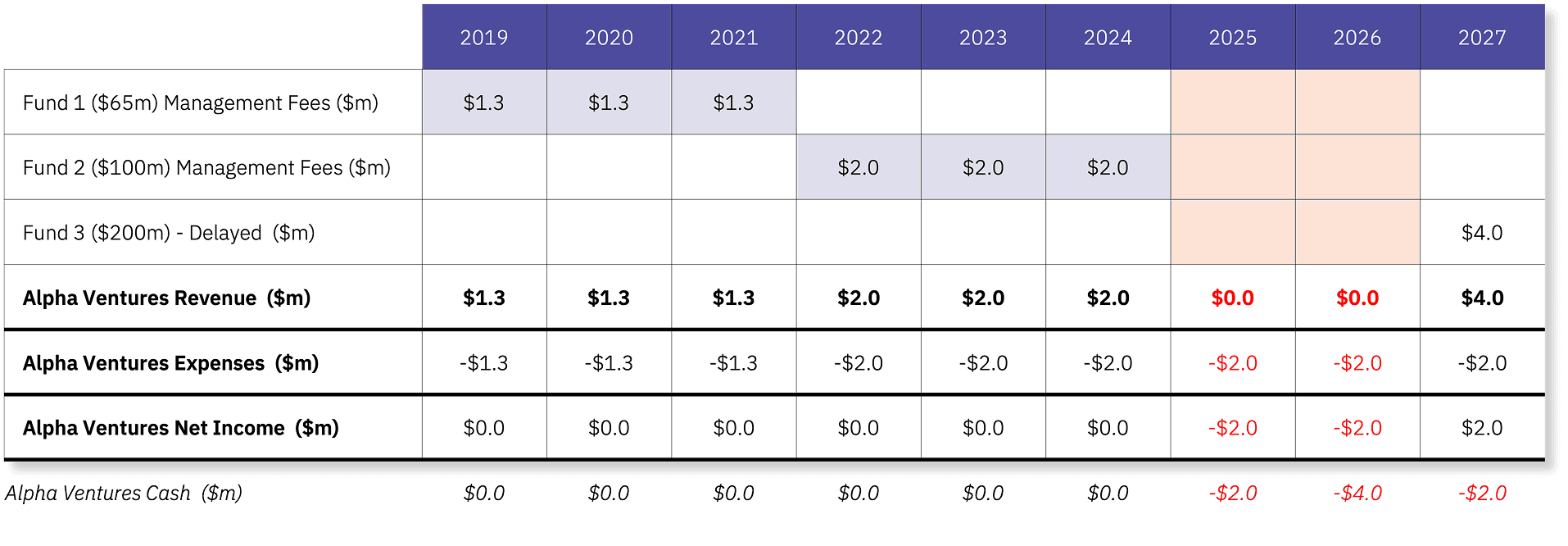

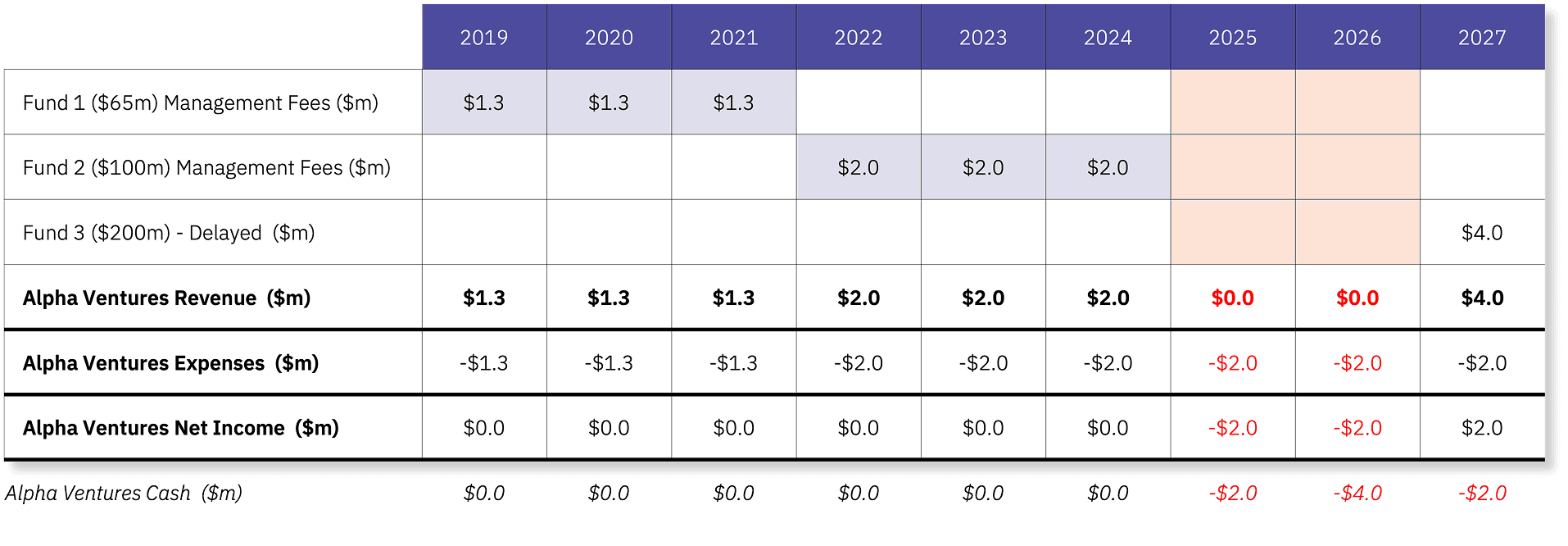

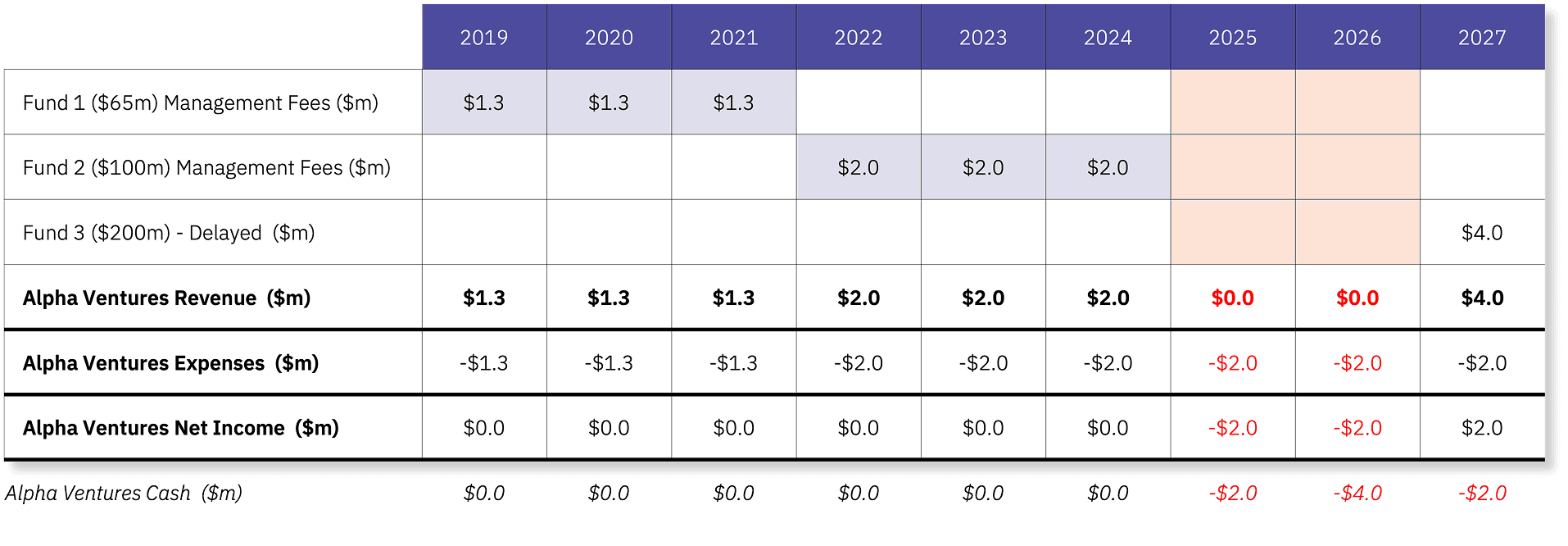

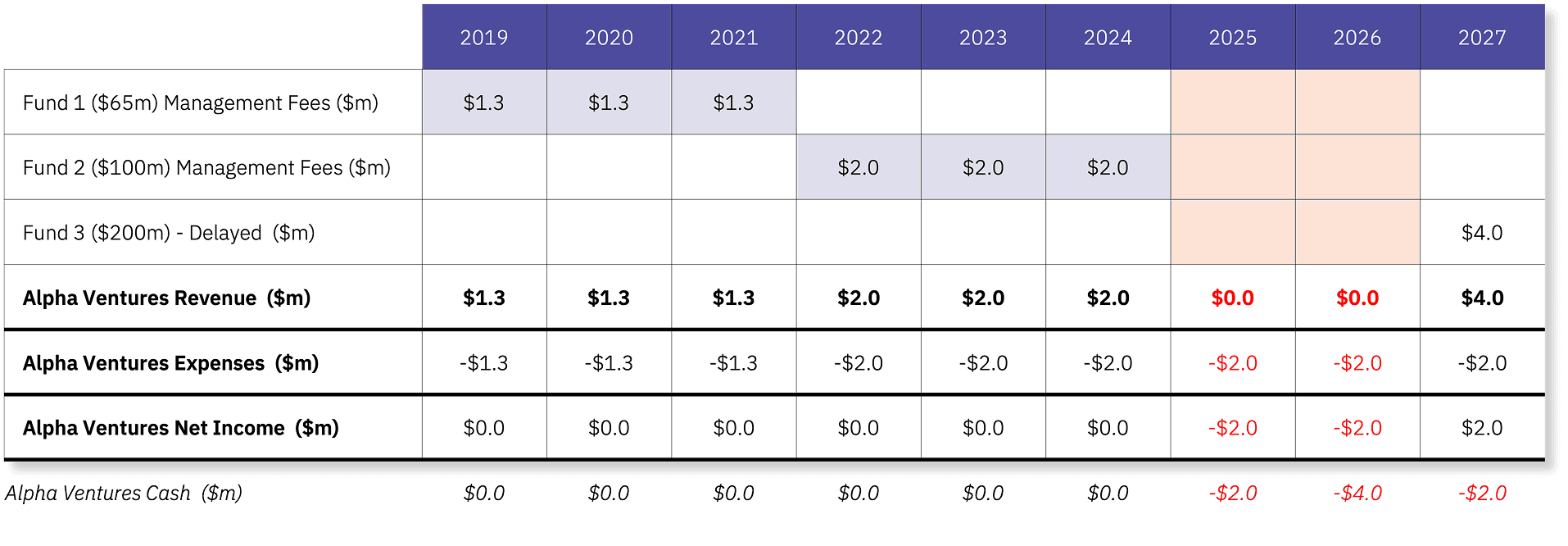

Alpha Ventures Cash Flow Profile

Two months ahead of Alpha Fund 3’s (AF3) first close in late 2024, Alpha Ventures (AV) corporate anchor LP (InvestCorp) pulled out of the fund. InvestCorp gained a new CEO who wanted to halt all new VC fund investments and sell their existing corporate VC book through an intermediary bank-coordinated auction process.

AV has two funds:

2018 vintage VC Fund (Alpha Fund 1 – AF1) with $65m in LP commitments. AF1 is currently valued at $330 million on a fair market basis.

2022 vintage VC Fund (Alpha Fund 2 – AF2) with $100m in LP commitments. AF2 is currently valued at $200 million on a fair market basis.

Accruing management fees is common practice for VC firms, and it is done for two primary reasons:

Reserving cash for management fees reduces investment capital. Maximising investment capital (as a proportion of LP commitments) increases the probability of strong returns (and generating carried interest).

The expectation of cash flows from future funds being sufficient to cover the firm's opex needs.

Alpha Ventures Cash Flow Profile

An anchor LP pulls out of Fund 3 at the last minute

Waiting for Company D’s impending exit

The AV team has high conviction that AF1’s core portfolio company, Company D, will be sold (in a cash sale) to a strategic acquirer within 24 months.

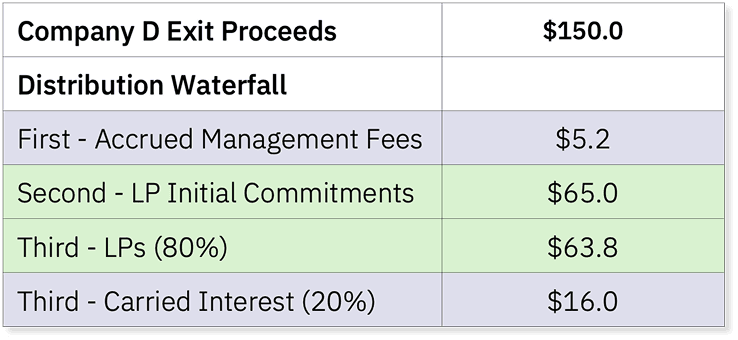

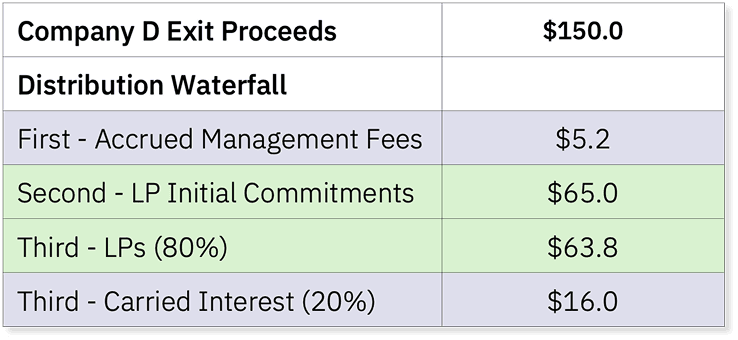

When Company D is sold, AF1 should receive cash proceeds of at least $150m, which will flow through the fund’s waterfall in the following ranking.

The AV team can see that the cash inflows are sufficient to repay the NAV facility with a significant margin of safety.

The AV team has high conviction that AF1’s core portfolio company, Company D, will be sold (in a cash sale) to a strategic acquirer within 24 months.

When Company D is sold, AF1 should receive cash proceeds of at least $150m, which will flow through the fund’s waterfall in the following ranking.

The AV team can see that the cash inflows are sufficient to repay the NAV facility with a significant margin of safety.

Waiting for Company D’s impending exit

A call to Nodem: NAV financing to address AV’s cash flow situation.

Alpha Ventures CFO calls Nodem to explain the firm’s cash flow issue. In collaboration with Nodem’s team, it was decided that there were several NAV pools against which Nodem could provide present cash flows in the form of a NAV facility.

NAV pool options

As a reminder, the LP NAV is lower than the portfolio FMV as it incorporates outstanding fees/expenses.

Alpha Ventures CFO calls Nodem to explain the firm’s cash flow issue. In collaboration with Nodem’s team, it was decided that there were several NAV pools against which Nodem could provide present cash flows in the form of a NAV facility.

NAV pool options

As a reminder, the LP NAV is lower than the portfolio FMV as it incorporates outstanding fees/expenses.

AF1’s $330m in portfolio fair market value (FMV).

AF2’s $200m in portfolio FMV

Alpha Ventures AF1 LP stake (prior GP commit) worth $13.6m (5% of AF1 NAV)

Alpha Ventures AF1 accrued carried interest.

AF1’s $330m in portfolio fair market value (FMV).

AF2’s $200m in portfolio FMV

Alpha Ventures AF1 LP stake (prior GP commit) worth $13.6m (5% of AF1 NAV)

Alpha Ventures AF1 accrued carried interest.

carried interest is calculated as 20% of AF1’s residual value. Residual value calculated as today's FMV minus all accrued fees/expenses and minus the return of all LP AF1 commitments.

carried interest is calculated as 20% of AF1’s residual value. Residual value calculated as today's FMV minus all accrued fees/expenses and minus the return of all LP AF1 commitments.

Nodem and AV decide that a $5m Nodem NAV facility would be best secured against the team’s (i) LP stake in AF1 and (ii) accrued carried interest in AF1.

It would also be possible for the fund itself to secure the financing. Still, it would require a less straightforward approval process, as the current Limited Partnership Agreement (LPA) does not explicitly include the use of the NAV facility (at the fund level).

Nodem and AV decide that a $5m Nodem NAV facility would be best secured against the team’s (i) LP stake in AF1 and (ii) accrued carried interest in AF1.

It would also be possible for the fund itself to secure the financing. Still, it would require a less straightforward approval process, as the current Limited Partnership Agreement (LPA) does not explicitly include the use of the NAV facility (at the fund level).

A call to Nodem: NAV financing to address AV’s cash flow situation.

The cost of NAV financing

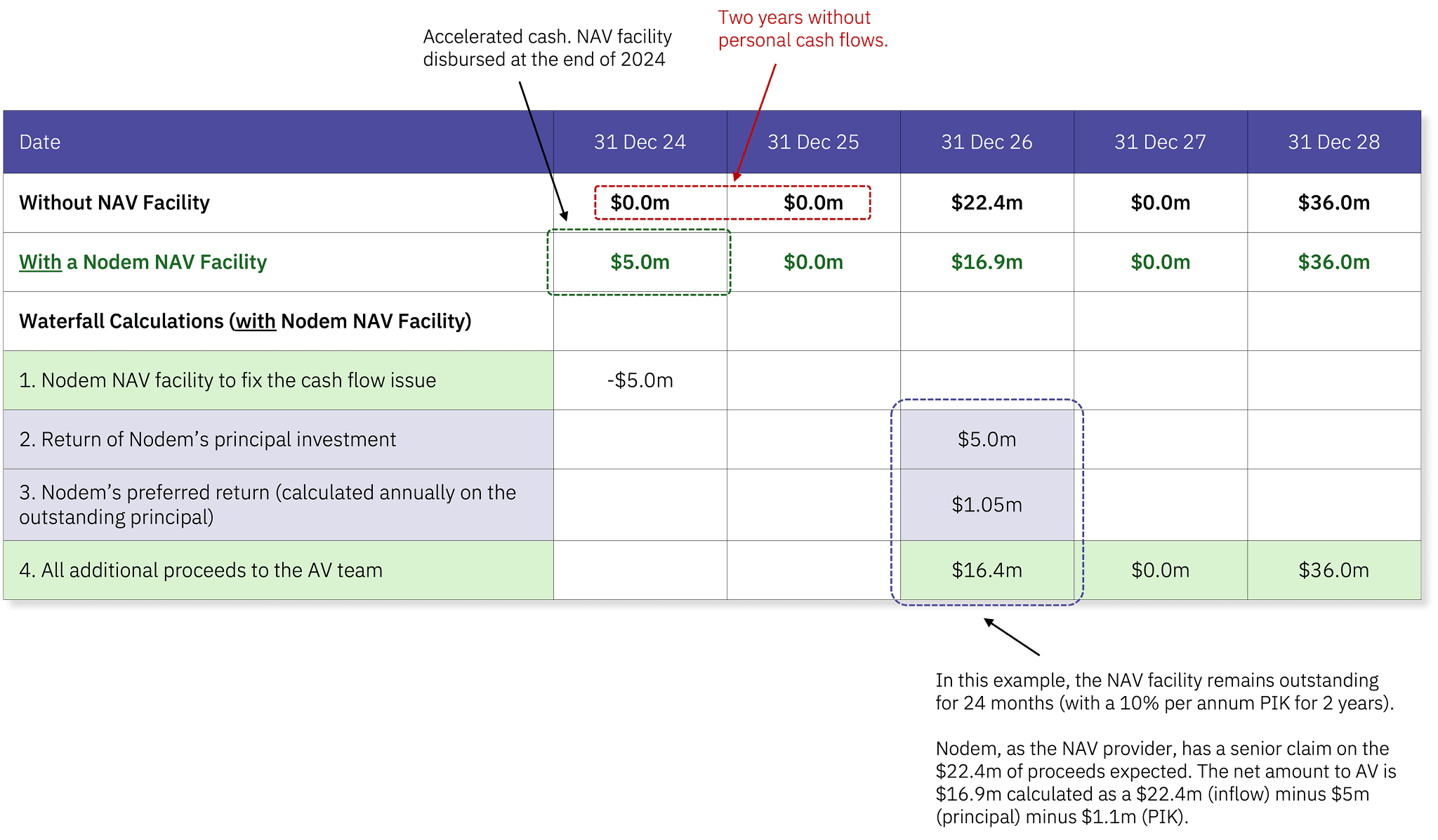

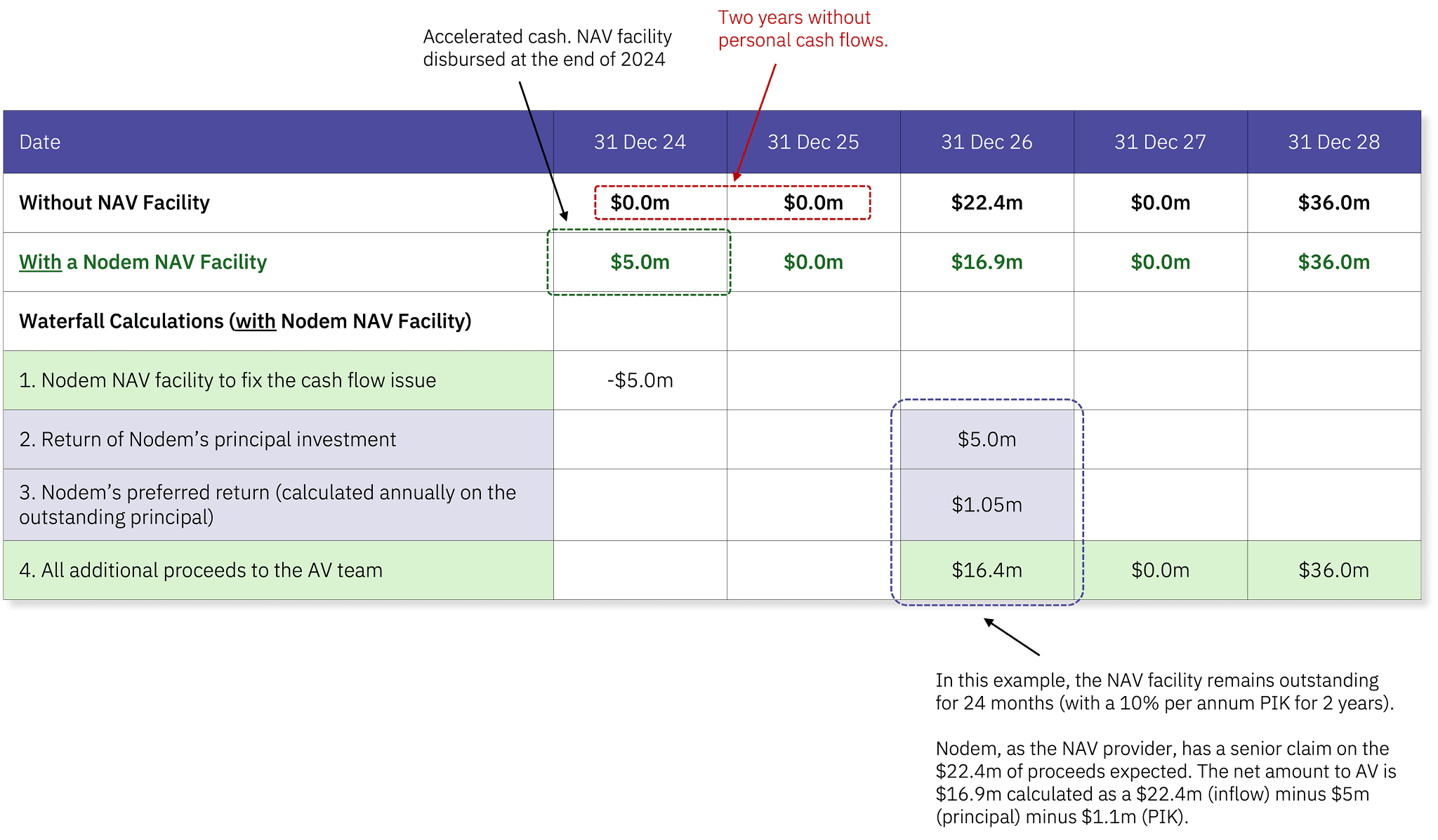

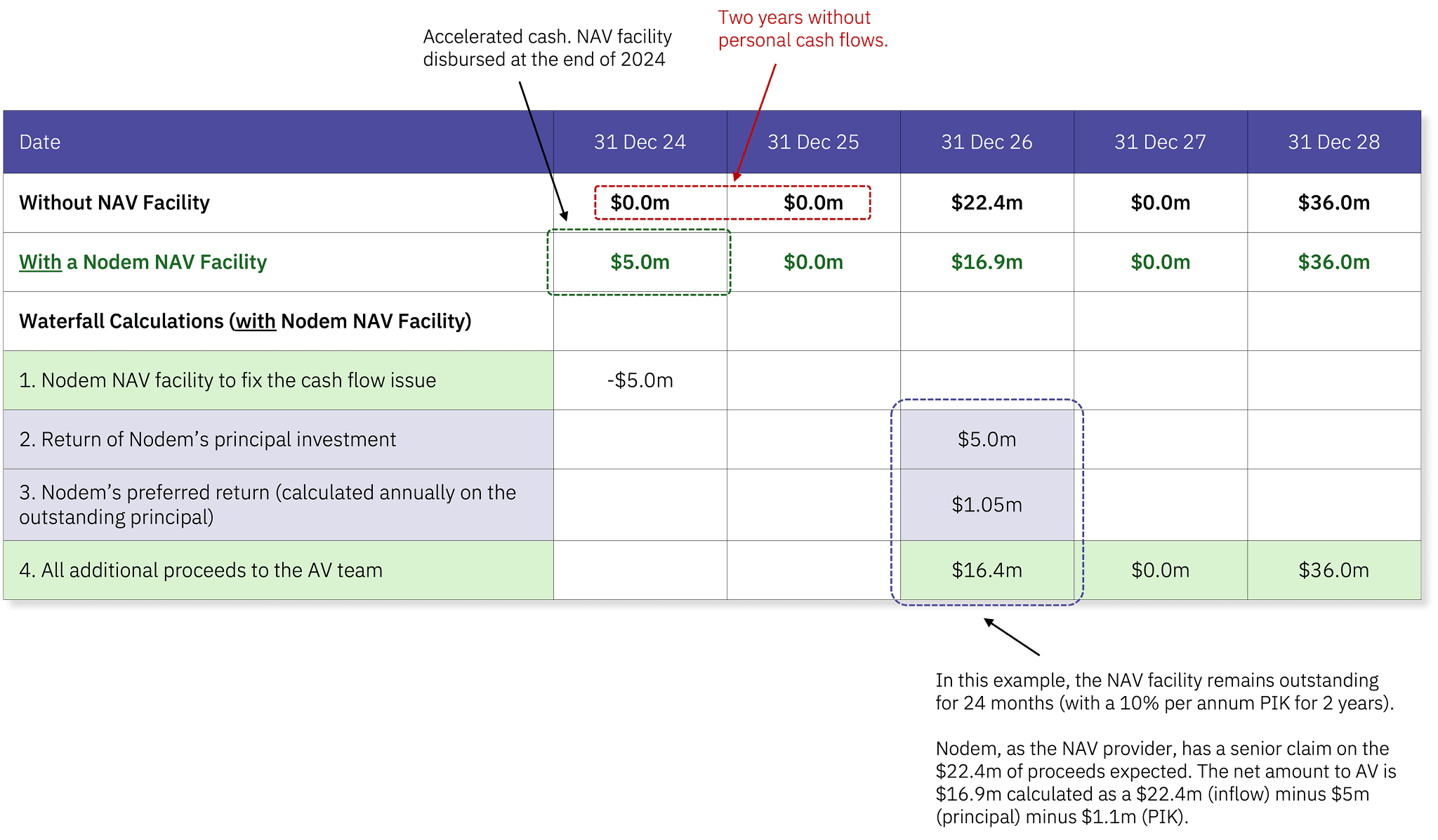

In the example below, Nodem’s $5m NAV facility is disbursed on 31st December 2024. The capital in the AV management company’s bank account is used to make payroll and pay outstanding invoices.

Nodem’s NAV facility is outstanding for a full 2 years until 31st December 2026, when the team receives $22.4m of inflows. The $22.4m constitutes the sum of $16m in carried interest and $6.4m in DPI, as the AV team is a 5% LP in AF 1 (prior GP commit).

Unlike a bank, for a non-bank NAV lender, the facility is drawn at once or in a few major chunks. This ensures a minimum return to Nodem (the NAV provider) to justify working on the transaction. NAV term durations tend to be 1-5 years or more.

The table below shows the AV team’s expected personal waterfall from their AF1 LP stake and carried interest. The top row shows the waterfall without a NAV facility, the row below shows illustrative cash flows with a NAV facility.

In the example below, Nodem’s $5m NAV facility is disbursed on 31st December 2024. The capital in the AV management company’s bank account is used to make payroll and pay outstanding invoices.

Nodem’s NAV facility is outstanding for a full 2 years until 31st December 2026, when the team receives $22.4m of inflows. The $22.4m constitutes the sum of $16m in carried interest and $6.4m in DPI, as the AV team is a 5% LP in AF 1 (prior GP commit).

Unlike a bank, for a non-bank NAV lender, the facility is drawn at once or in a few major chunks. This ensures a minimum return to Nodem (the NAV provider) to justify working on the transaction. NAV term durations tend to be 1-5 years or more.

The table below shows the AV team’s expected personal waterfall from their AF1 LP stake and carried interest. The top row shows the waterfall without a NAV facility, the row below shows illustrative cash flows with a NAV facility.

Over the entire Fund’s life, the Total returns the AV team expect from their AF1 LP commitment (prior GP commitment) and future Carried Interest.

Importantly, not selling an LP stake or carry share means that the team can take liquidity without giving away the prospect of further outsized upside.

Over the entire Fund’s life, the Total returns the AV team expect from their AF1 LP commitment (prior GP commitment) and future Carried Interest.

Importantly, not selling an LP stake or carry share means that the team can take liquidity without giving away the prospect of further outsized upside.

What are the costs and potential risks?

In this example, the total Nodem balance and PIK were outstanding for 2 years.

Nodem gets paid back 24 months from the disbursement of the liquidity the team gets from the sale of Company D.

For mathematical simplicity, the $5m facility accrues PIK interest at 10% per annum. Costing the firm $1.05m. If there were delays in distribution, the outstanding balance would continue to accrue interest at the specified rate.

What are the costs and potential risks?

In this example, the total Nodem balance and PIK were outstanding for 2 years.

Nodem gets paid back 24 months from the disbursement of the liquidity the team gets from the sale of Company D.

For mathematical simplicity, the $5m facility accrues PIK interest at 10% per annum. Costing the firm $1.05m. If there were delays in distribution, the outstanding balance would continue to accrue interest at the specified rate.

The cost of NAV financing

Related case studies

Participate in a

pay-to-play round

CASE STUDY 1

Unlock accrued

fees

CASE STUDY 2

Bridge an LP anchor

commit

CASE STUDY 3

Accelerate cash

distributions

CASE STUDY 4

Fund a leadership

transition

CASE STUDY 5

Raise investment

capital

CASE STUDY 6

Refinance existing

debt

CASE STUDY 7

Support a portfolio

buyout

CASE STUDY 8

London Office

Nodem Ltd

1a Britannia Street

London

United Kingdom

WC1X 9JT

Nodem Ltd is authorised and regulated by the Financial Conduct Authority, FRN 1017481. Company number 15661530. Nodem Ltd is registered in England and Wales under company number 15661530.

This website is for informational purposes only and does not constitute an offer, solicitation, or recommendation to sell or an offer to purchase any securities, investment products, or investment advisory services. This website and the information set forth herein are current as of 4 June 2025 and are not intended to provide investment recommendations or advice.

London Office

Nodem Ltd

1a Britannia Street

London

United Kingdom

WC1X 9JT

Nodem Ltd is authorised and regulated by the Financial Conduct Authority, FRN 1017481. Company number 15661530. Nodem Ltd is registered in England and Wales under company number 15661530.

This website is for informational purposes only and does not constitute an offer, solicitation, or recommendation to sell or an offer to purchase any securities, investment products, or investment advisory services. This website and the information set forth herein are current as of 4 June 2025 and are not intended to provide investment recommendations or advice.

London Office

Nodem Ltd

1a Britannia Street

London

United Kingdom

WC1X 9JT

Nodem Ltd is authorised and regulated by the Financial Conduct Authority, FRN 1017481. Company number 15661530. Nodem Ltd is registered in England and Wales under company number 15661530.

This website is for informational purposes only and does not constitute an offer, solicitation, or recommendation to sell or an offer to purchase any securities, investment products, or investment advisory services. This website and the information set forth herein are current as of 4 June 2025 and are not intended to provide investment recommendations or advice.