Africa’s S-Curves

Stephen Deng has written a fascinating article on Africa’s S curves. Whilst Stephen says the phenomenon is unique to African markets, we believe the same principle can apply to many other frontier emerging markets.

The original article can be found here (link). Tribe Capital's post on the subject can be found here (link).

Article Summary:

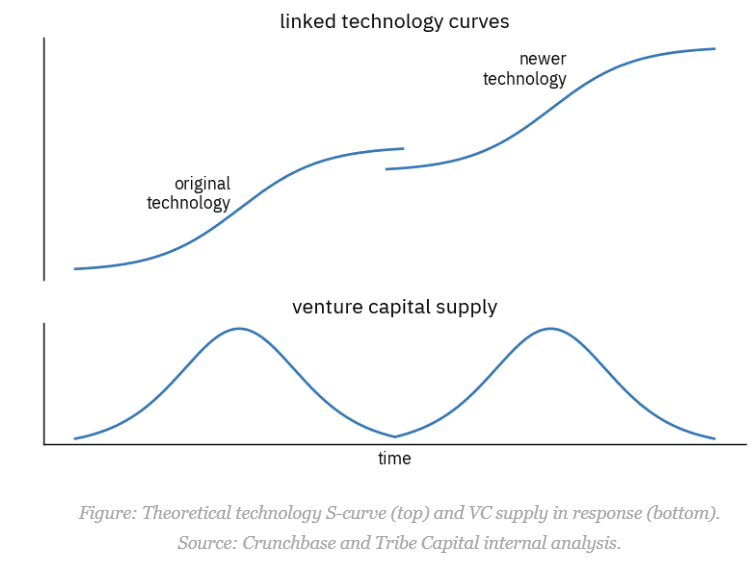

The venture capital model of tech investing is based on the S curve. Here’s an article from a quarter century ago that explains this concept. And here’s a recent take from Tribe Capital. Traditionally, VCs profit by investing in emerging tech before it’s mainstream and exiting when growth plateaus, making way for the next S curve. Stephen proposes that African S curves have much longer tails and steeper slopes. When pockets of innovation find traction in today’s markets, the improvement, uptake, and movement up an S curve can be dramatic. As a result, investors should not fall prey to pessimism when they begin to see the limitations of Africa’s leapfrog narrative and miss the massive opportunities ahead of us that are unique to this geography.

Lessons

The piece offers several lessons for primary and secondary investors across all emerging markets. By understanding the unique dynamics of a given emerging market, adjusting valuation expectations, and adopting a long-term perspective, investors can identify undervalued assets and generate attractive returns.

Longer Tail of S-Curves: Emerging market tech adoption cycles can be long. This implies that companies may take longer than standard fund lives to reach scale compared to other regions. Investors should adjust their valuation expectations and factor in a longer time horizon for returns. To avoid forced selling, Nodem is positioned to provide this at the fund and asset levels to provide additional time towards an exit and a maximal value.

Overestimation of Market Readiness: The "leapfrog" narrative, while potentially true in the long term, has led to overestimating current market readiness for certain technologies. This miscalculation has led to between 10x – 20x as many companies being financed by VCs than exited (depending on the market/region). Secondary investors should carefully scrutinise companies' underlying assumptions about market adoption and growth within their exit horizon.

Shift from "Leapfrog" to "Augment": Successful companies are more likely to augment existing informal markets and leverage social trust rather than try to replace them with purely digital solutions. Look for companies demonstrating this "cyborg" approach, blending online and offline strategies.

Steeper Slope Potential: While adoption cycles are longer, once a technology gains traction, the growth can be rapid (steeper slopes of S-curves). This presents opportunities for secondary investors to identify companies that have navigated the initial slow growth phase and are poised for rapid expansion.

Focus on "Cybernetic Commerce": The article identifies "cybernetic commerce" – a blend of online and offline, digital and physical approaches – as a significant opportunity. Secondary investors should prioritise companies operating within sectors like social selling, food value chains, and mobile money that embody this approach.

Potential for Market Correction: Given the mismatch between previous valuations and market realities, there may be attractive opportunities in the secondary market as companies adjust to a new funding environment. Look for fundamentally sound companies with strong unit economics that may be undervalued due to the broader market sentiment.

Read more about the Indian exit environment here.

Disclosures