How many VC-backed unicorns will remain unicorns? Lessons for interim secondary market investors.

Secondary markets for VC-backed assets require investors to focus on realism and fundamentals. At Nodem, we see valuations becoming more realistic, with a greater emphasis on fundamental business metrics.

Original article: https://www.eu.vc/p/thinning-the-herd-50-of-unicorns

The 2020-21 hangover of inflated valuations is still with us in emerging markets VC. Still, this exuberance is not reflected in the PE/strategic buyers to whom many companies will ultimately be exited.

30% of All Active Unicorns Have Already Been De-Horned Based on Secondary Valuations

+30% of 2021 unicorns have fallen below the $1 billion threshold, as indicated by recent secondary market transactions. This appears to be a mixture of exuberant valuations in 2021 and missed growth/profitability targets. Based on our internal emerging markets data, we see a similar % of unicorns losing their 2021 unicorn status.

Many Unicorns Now Resemble “PE Targets” Based on Revenue and Growth Metrics

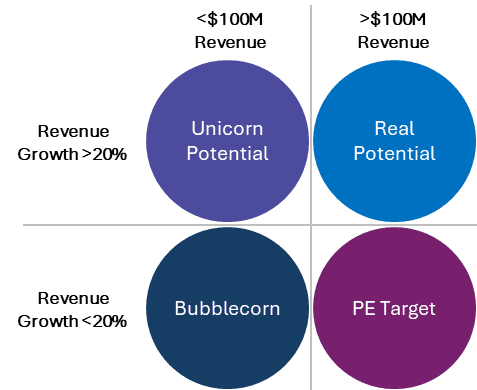

Justine and Wiley split the paper unicorns into four buckets (see below): Bubblecorns (3%). PE Targets (28%), Unicorn Potential (19%), Real Unicorns (50%). The fact that 28% was also the number of Indian VC-backed exits to PE in 2023 is not a coincidence. We expect this exit to grow from a low base across all emerging markets.

The companies that fell into the “PE target” bucket had moderate revenue scale but slowed growth, and so were more obvious sponsor-to-sponsor buyout targets.

Source: Industry Ventures

Unicorn Sectors Are Not All Created Equal

Their analysis reveals significant performance disparities across different Unicorn sectors. Enterprise SaaS remains the largest and most resilient, accounting for nearly 40% of Unicorns across all time periods. Crypto and EdTech have experienced a decline in new Unicorns and valuations, reflecting a more challenging market environment. AI has emerged as a bright spot, attracting significant investment and producing a new wave of high-growth companies.