What Do ‘Structured Liquidity Solutions’ Mean Within Private Markets?

The term ‘structured liquidity solutions’ is becoming increasingly prevalent in the private markets lexicon, yet its precise meaning can often seem opaque.

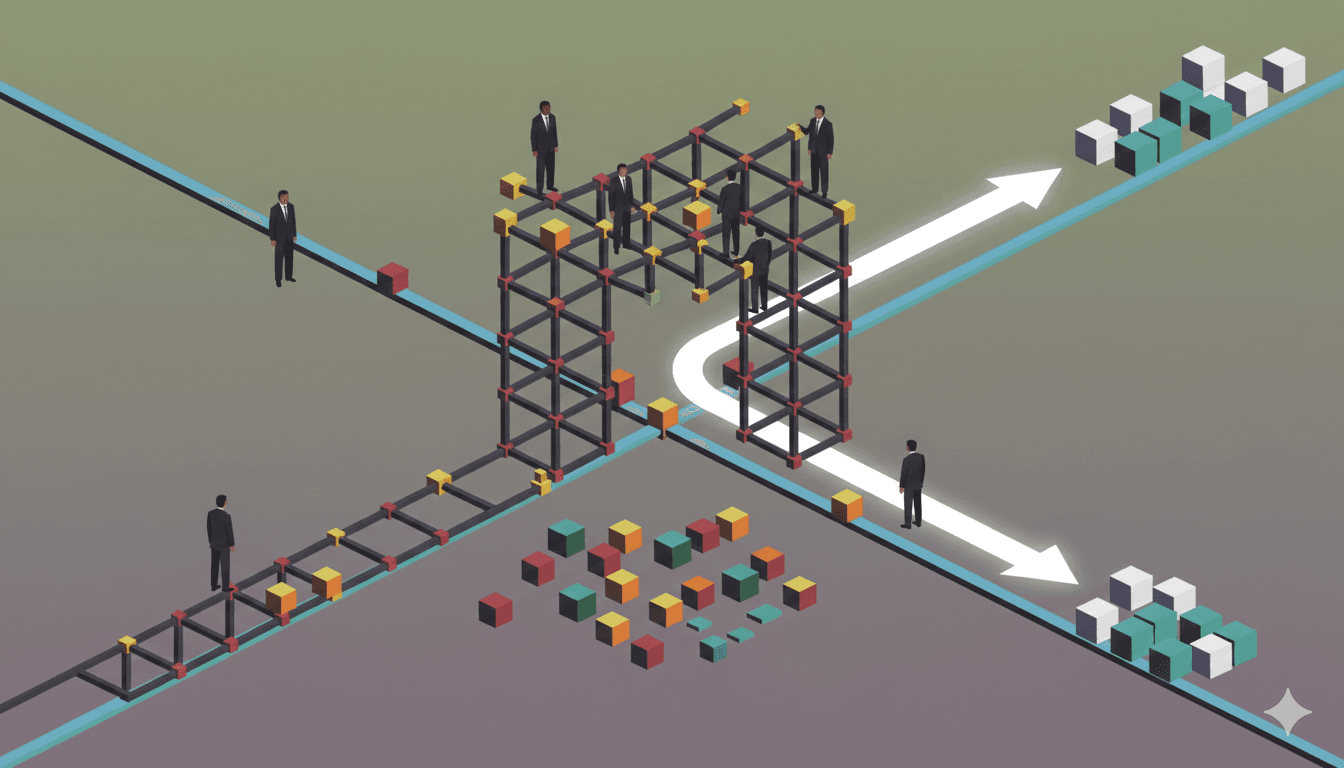

In essence, it refers to a range of sophisticated financing techniques that are designed to provide liquidity to investors and fund managers who hold illiquid assets, such as private equity and venture capital fund interests. Unlike simple, vanilla lending, structured solutions are highly bespoke and are tailored to the specific circumstances and objectives of the borrower.

At the heart of most structured liquidity solutions is the concept of asset-backed financing. The loan is secured against a portfolio of private assets, with the lender’s recourse typically limited to the cash flows generated by those assets. This is a fundamental departure from traditional corporate or personal lending, where the lender may have recourse to the borrower’s entire balance sheet.

Net Asset Value (NAV) financing is a prime example of a structured liquidity solution. In a NAV financing, the lender provides a loan based on the value of a portfolio of private fund interests. The loan is structured to match the cash flow profile of the underlying assets, with repayments typically made from the distributions generated by the portfolio. This structure allows the borrower to monetise a portion of the value of their illiquid holdings without having to sell them, thereby preserving their long-term equity upside.

The ‘structured’ element of these solutions comes from the way they are tailored to address specific challenges and objectives. For example, a solution could be structured to help a Limited Partner (LP) avoid a capital call default, to enable a General Partner (GP) to make a follow-on investment in a portfolio company, or to provide a family office with the capital to rebalance its portfolio. The terms of the loan, including the interest rate, maturity, and collateral package, are all carefully crafted to meet these specific needs.

Furthermore, structured liquidity solutions can involve complex legal and financial engineering to navigate the intricacies of fund agreements, tax regulations, and other market constraints. This might involve the use of special purpose vehicles (SPVs), derivatives, or other financial instruments to create the desired outcome for the borrower.

This article is a blog post from a regulated firm and does not constitute financial advice.