CASE STUDY 1

Losing a key portfolio company due to a lack of available funding. How NAV-financing could help.

This document is for illustrative purposes only and does not constitute financial or legal advice. The case study presented is a hypothetical and simplified illustration of a complex financial instrument. It is not intended to be representative of all situations and should not be relied upon for investment decisions.

Pay-to-play. Losing a key portfolio company and reputation due to a lack of liquidity. How NAV-financing helps.

This document is for illustrative purposes only and does not constitute financial or legal advice. The case study presented is a hypothetical and simplified illustration of a complex financial instrument. It is not intended to be representative of all situations and should not be relied upon for investment decisions.

A difficult day in the office

A difficult day in the office

The message from the founder to the GP was clear and concise. His portfolio company, Company C, was caught off guard on the glide path to profitability and needs a $50m capital injection. The trouble is, Company C is a high-quality business with world-class management, but it is having a tough time due to an exogenous market event.

Company C is now a major company in the GP’s fund (Alpha fund 1).

Not participating in the $50m capital injection (the offer from the founder) means Alpha Fund 1’s position being wiped out economically, straining the relationship with both the founder and Alpha Fund’s LPs (ahead of a new fundraise).

Not to mention the reputational damage - not standing by your founders and dropping them.

Because he can’t participate, the GP has no choice but to explain that he has drawn LPs 100% and has no capital to invest.

The GP prepares a communication to LPs explaining that Fund 1 has lost $105 million (nearly a third of Fund NAV) and is preparing a wave of explanatory calls with LPs (most of which are in active Fund 3 DD).

The message from the founder to the GP was clear and concise. His portfolio company, Company C, was caught off guard on the glide path to profitability and needs a $50m capital injection. The trouble is, Company C is a high-quality business with world-class management, but it is having a tough time due to an exogenous market event.

Company C is now a major company in the GP’s fund (Alpha fund 1).

Not participating in the $50m capital injection (the offer from the founder) means Alpha Fund 1’s position being wiped out economically, straining the relationship with both the founder and Alpha Fund’s LPs (ahead of a new fundraise).

Not to mention the reputational damage - not standing by your founders and dropping them.

Because he can’t participate, the GP has no choice but to explain that he has drawn LPs 100% and has no capital to invest.

The GP prepares a communication to LPs explaining that Fund 1 has lost $105 million (nearly a third of Fund NAV) and is preparing a wave of explanatory calls with LPs (most of which are in active Fund 3 DD).

If the GP had reached out to Nodem, this scenario could have been very different.

The GP would instead have announced to LPs that Alpha Fund 1 invested in the new round faster than others on the cap table – preserving economic value and building an even stronger reputation.

Protecting value: The down round

Context: Alpha Fund 1 lacks capital to protect 32% of its current NAV

A 2018 vintage VC Fund (Alpha Fund 1) has $330m in fund NAV.

A portfolio company (Company C) currently constitutes 32% of fund NAV but urgently requires fresh capital to restructure the business. To raise this capital, Company C has launched a $50m down round.

For Alpha Fund 1’s GP, the decision is: (i) don’t participate, locking in a total loss of $105m in current NAV, or (ii) participate in the round to protect/build value.

The GP has decided that contributing $18.75m to the $50m down round would be optimal for Alpha Fund 1.

However, the GP has a major problem: Alpha Fund 1 has already drawn 100% of its LP capital and is midway through a new Fund 3 launch.

Nodem’s solution: Nodem provided an $18.75m NAV facility within 4-6 weeks secured by Alpha Fund 1’s broader portfolio.

How did the GP decide on the $18.75m investment?

Alpha Fund 1 portfolio (as of 31 October 2025)

All numbers quoted in USD millions. Assumes no subsequent ownership dilution after the initial investment.

Context: Alpha Fund 1 lacks capital to protect 32% of its current NAV

A 2018 vintage VC Fund (Alpha Fund 1) has $330m in fund NAV.

A portfolio company (Company C) currently constitutes 32% of fund NAV but urgently requires fresh capital to restructure the business. To raise this capital, Company C has launched a $50m down round.

For Alpha Fund 1’s GP, the decision is: (i) don’t participate, locking in a total loss of $105m in current NAV, or (ii) participate in the round to protect/build value.

The GP has decided that contributing $18.75m to the $50m down round would be optimal for Alpha Fund 1.

However, the GP has a major problem: Alpha Fund 1 has already drawn 100% of its LP capital and is midway through a new Fund 3 launch.

Nodem’s solution: Nodem provided an $18.75m NAV facility within 4-6 weeks secured by Alpha Fund 1’s broader portfolio.

How did the GP decide on the $18.75m investment?

Alpha Fund 1 portfolio (as of 31 October 2025)

All numbers quoted in USD millions. Assumes no subsequent ownership dilution after the initial investment.

The history of Company C

Alpha Fund 1 initially invested $15m in Company C at a $30m pre-money ($60m post-money) valuation.

The company initially grew its revenues strongly, achieving a $420m valuation.

By early 2025, Company C had struggled to find profitability for many of its new business lines, and its cash reserves had dwindled, but it left a very healthy core business.

The history of Company C

Alpha Fund 1 initially invested $15m in Company C at a $30m pre-money ($60m post-money) valuation.

The company initially grew its revenues strongly, achieving a $420m valuation.

By early 2025, Company C had struggled to find profitability for many of its new business lines, and its cash reserves had dwindled, but it left a very healthy core business.

The history of Company C

Alpha Fund 1 initially invested $15m in Company C at a $30m pre-money ($60m post-money) valuation.

The company initially grew its revenues strongly, achieving a $420m valuation.

By early 2025, Company C had struggled to find profitability for many of its new business lines, and its cash reserves had dwindled, but it left a very healthy core business.

The history of Company C

Alpha Fund 1 initially invested $15m in Company C at a $30m pre-money ($60m post-money) valuation.

The company initially grew its revenues strongly, achieving a $420m valuation.

By early 2025, Company C had struggled to find profitability for many of its new business lines, and its cash reserves had dwindled, but it left a very healthy core business.

The down round: On November 1, 2025, Company C announces a $50m punitive down round (set to close 31st December 2025).

The down round: On November 1, 2025, Company C announces a $50m punitive down round (set to close 31st December 2025).

Down round terms:

In October 2025, the Company announced a $50m down round ($200m post-money valuation). The $50m will be used to rationalise the business and focus on areas of profitability ahead of an anticipated $300m sale to a strategic buyer next year.

Those participating in the $50m round are receiving extremely generous terms.

A 4x liquidation preference.

Existing investors have the right to pull up (convert to the new round) 1 of their existing shares for every new share purchased.

The GP has two primary options:

Option 1: Don’t participate and lose $105m of fund NAV (SEE ABOVE).

The new round terms render existing shares worthless, given the high probability of a $300 million strategic sale next year that would not clear the outstanding liquidity preferences.

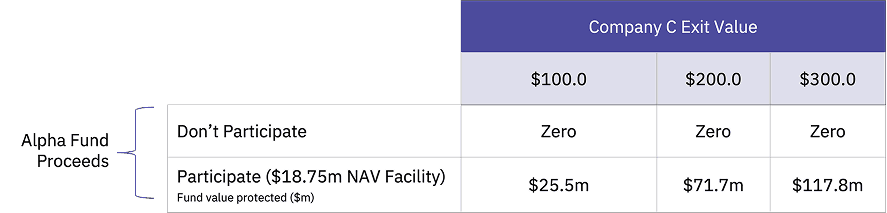

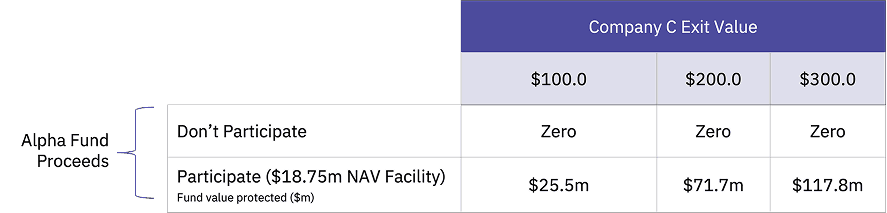

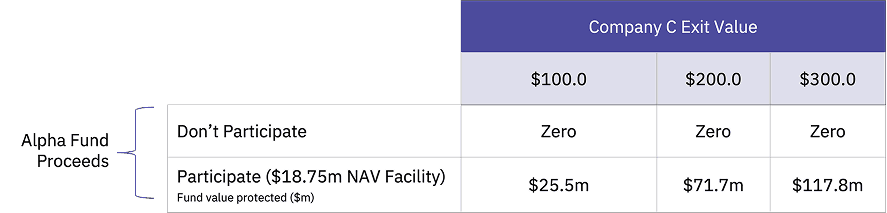

Decision-making table showing the proceeds to Alpha Fund 1 from Company C at a $100m, $200m and $300m (expected) valuation.

Down round terms:

In October 2025, the Company announces a $50m down round ($200m post-money valuation). The $50m will be used to rationalise the business and focus on areas of profitability ahead of an anticipated $300m sale to a strategic buyer next year.

Those participating in the $50m round are receiving extremely generous terms.

A 4x liquidation preference.

Existing investors have the right to pull up (convert to the new round) 1 of their existing shares for every new share purchased.

The GP has two primary options:

Option 1: Don’t participate and lose $105m of fund NAV.

The new round terms render existing shares worthless, given the high probability of a $300 million strategic sale next year that would not clear the outstanding liquidity preferences.

Decision-making table showing the proceeds to Alpha Fund 1 from Company C at a $100m, $200m and $300m (expected) valuation.

Note: See assumptions below. These returns already incorporate the repayment of Nodem’s facility and 1 year of interest expense.

Conclusion: Not participating results in a total loss of value. Assuming the residual companies helped Alpha Fund 1 maintain its current NAV value as of 31st December 2028 (year 10), the fund would have achieved a 14.1% Gross IRR.

Conclusion: Not participating results in a total loss of value. Assuming the residual companies helped Alpha Fund 1 maintain its current NAV value as of 31st December 2028 (year 10), the fund would have achieved a 14.1% Gross IRR.

Conclusion: Not participating results in a total loss of value. Assuming the residual companies helped Alpha Fund 1 maintain its current NAV value as of 31st December 2028 (year 10), the fund would have achieved a 14.1% Gross IRR.

Option 2: Protect value by taking a Nodem facility worth $18.75m and potentially PROTECT up to $117.8m of value from Company C.

The GP chooses to take a $18.75m facility from Nodem to participate in Company C’s new round.

Company C’s latest investment round (as before: $200m post-money) is summarised below:

Alpha Fund 1, as an existing investor, utilises a $18.75m Nodem facility to buy 7.5m of new shares. This also has the effect of “pulling up” 7.5m of existing shares.

A New Investor invests $18.75m for 7.5m shares.

Beta Fund 1, an existing investor, invests $12.5m to buy 5m of new shares. This also has the effect of “pulling up” 5m of existing shares to the latest round class.

Option 2: Protect value by taking a Nodem facility worth $18.75m and potentially PROTECT up to $117.8m of value from Company C.

The GP chooses to take a $18.75m facility from Nodem to participate in Company C’s new round.

Company C’s latest investment round (as before: $200m post-money) is summarised below:

Alpha Fund 1, as an existing investor, utilises a $18.75m Nodem facility to buy 7.5m of new shares. This also has the effect of “pulling up” 7.5m of existing shares.

A New Investor invests $18.75m for 7.5m shares.

Beta Fund 1, an existing investor, invests $12.5m to buy 5m of new shares. This also has the effect of “pulling up” 5m of existing shares to the latest round class.

IMPORTANT: The liquidity preference

With the company set to be sold for $300m (below the value of the liquidity preference), the only figure that matters for a Company C investor is their percentage of the liquidity preference. This percentage represents the portion of the total proceeds an investor will receive upon exit.

IMPORTANT: The liquidity preference

With the company set to be sold for $300m (below the value of the liquidity preference), the only figure that matters for a Company C investor is their percentage of the liquidity preference. This percentage represents the portion of the total proceeds an investor will receive upon exit.

Assuming no Company C debt, Alpha Fund 1 will receive a minimum of 46.2% of all proceeds upon a $300m exit. From these proceeds, Nodem would need to be repaid the $18.75m plus any accrued PIK interest.

Alpha Fund 1 receives Nodem’s present cash flows ($18.75m) in exchange for re-ordering future fund cash flows.

Step 1 (establishing terms): Alpha Fund 1’s GP reaches out to Nodem to discuss liquidity options. After diligent review of the portfolio, Nodem extends a term sheet specifying $18.75 million to Alpha Fund 1 with a 10% per annum Payment-in-Kind (PIK) interest. Terms are accepted, and the deal is structured in a tax-efficient manner. The $18.75m represents 8.3% of Alpha Fund 1’s portfolio; this is the facility's “loan-to-value” (LTV).

Step 2: The GP immediately draws 100% of the $18.75m Nodem facility to purchase the new Company C shares.

Step 3: When the investment is made, a new Alpha Fund 1 waterfall is created, whereby Alpha Fund 1’s next exit proceeds must be used to repay Nodem’s investment, plus outstanding interest.

Assuming no Company C debt, Alpha Fund 1 will receive a minimum of 46.2% of all proceeds upon a $300m exit. From these proceeds, Nodem would need to be repaid the $18.75m plus any accrued PIK interest.

Alpha Fund 1 receives Nodem’s present cash flows ($18.75m) in exchange for re-ordering future fund cash flows.

Step 1 (establishing terms): Alpha Fund 1’s GP reaches out to Nodem to discuss liquidity options. After diligent review of the portfolio, Nodem extends a term sheet specifying $18.75 million to Alpha Fund 1 with a 10% per annum Payment-in-Kind (PIK) interest. Terms are accepted, and the deal is structured in a tax-efficient manner. The $18.75m represents 8.3% of Alpha Fund 1’s portfolio; this is the facility's “loan-to-value” (LTV).

Step 2: The GP immediately draws 100% of the $18.75m Nodem facility to purchase the new Company C shares.

Step 3: When the investment is made, a new Alpha Fund 1 waterfall is created, whereby Alpha Fund 1’s next exit proceeds must be used to repay Nodem’s investment, plus outstanding interest.

Protecting value: down round

NAV Financing: Cost-to-Value

The new waterfall in dollar flows

In the example below, Company C is sold for $300m on 31st December 2026 (year 8), and the residual portfolio is sold on 31st December 2028 (year 10).

Nodem’s facility acts like leverage. The fund achieves a gross IRR of 20% rather than 14.1% if they did not participate. Alpha Fund 1’s MOIC is 5.7x versus 3.8x if the GP did not utilise Nodem.

The new waterfall in dollar flows

In the example below, Company C is sold for $300m on 31st December 2026 (year 8), and the residual portfolio is sold on 31st December 2028 (year 10).

Nodem’s facility acts like leverage. The fund achieves a gross IRR of 20% rather than 14.1% if they did not participate. Alpha Fund 1’s MOIC is 5.7x versus 3.8x if the GP did not utilise Nodem.

Value to Alpha Fund 1 if Company C were sold for $300m

From the Fund’s perspective: What's the break-even point for Nodem’s financing?

If the total Nodem balance and PIK were outstanding for 2 years, the breakeven Company C sale price would be $49.1 million (-84% of the anticipated sale price of $300 million). For a $49.1m Company C sale, Alpha Fund 1 would receive $22.7m (enough to repay Nodem).

If Company C was worth zero, Nodem would have a senior claim over the residual Alpha Fund 1 portfolio. It is this downside protection for Nodem that allows us to lower the price of a facility’s PIK.

From the Fund’s perspective: What's the break-even point for Nodem’s financing?

If the total Nodem balance and PIK were outstanding for 2 years, the breakeven Company C sale price would be $49.1 million (-84% of the anticipated sale price of $300 million). For a $49.1m Company C sale, Alpha Fund 1 would receive $22.7m (enough to repay Nodem).

If Company C was worth zero, Nodem would have a senior claim over the residual Alpha Fund 1 portfolio. It is this downside protection for Nodem that allows us to lower the price of a facility’s PIK.

NAV Financing: cost to value

A short history of Sequoia’s participation in Klarna’s 2022 down round

A short history of Sequoia’s participation in Klarna’s 2022 down round

A short history of Sequoia’s participation in Klarna’s 2022 down round

Klarna closes major financing round during worst stock downturn in 50 years.

Market context

When interest rates spiked in 2022, public market fintechs saw their stocks plummet. Private markets were hit equally hard, and most fintech startups, including Klarna, took a beating. Klarna’s losses tripled to $580 million from January to July of 2022. In 2022, Klarna’s valuation was slashed by a startling 85% and they were forced to raise a punitive down round.

The “pay to play” round (H-2)

Sequoia made the call to invest $135m to lead an $800 million round at a $6.7 billion valuation (down from $45.6bn). In addition to other repeat investors, Heartland, Silver Lake, and Commonwealth Bank of Australia, Mubadala and the Canadian Pension Plan Fund.

According to public sources, prior investors that didn’t participate in the new round were subordinated (shares likely converted to common) and massively diluted, effectively wiping out prior Klarna investments. Most participants in the H-2 round will have protected and grown value for their investor base.

Many world-class companies have faced difficult days in which VCs have had to step up with capital quickly. Think Robinhood and Ribbit Capital, or when Kalshi had its election markets shut down (again with Sequoia stepping in). Partnering with Nodem can enable you to move with speed to protect your portfolio companies.

Related case studies

GPs & Funds

Participate in play to play round

GPs & Funds

Bridge an LP anchor commit

Family Offices

Fuelling Investment Holding Company Growth with a NAV Facility

Family Offices

Wealth Transfer

Family Offices

Refinancing with a PIK-based facility

GPs & Funds

Unlock accrued fees

Family Offices

Unlock capital without selling growing private assets

Family Offices

Rebalance Portfolio

Family Offices

Bridging Capital Calls

Related case studies

GPs & Funds

Participate in play to play round

GPs & Funds

Bridge an LP anchor commit

Family Offices

Fuelling Investment Holding Company Growth with a NAV Facility

Family Offices

Wealth Transfer

Family Offices

Refinancing with a PIK-based facility

GPs & Funds

Unlock accrued fees

Family Offices

Unlock capital without selling growing private assets

Family Offices

Rebalance Portfolio

Family Offices

Bridging Capital Calls

Related case studies

GPs & Funds

Participate in play to play round

GPs & Funds

Bridge an LP anchor commit

Family Offices

Fuelling Investment Holding Company Growth with a NAV Facility

Family Offices

Wealth Transfer

Family Offices

Refinancing with a PIK-based facility

GPs & Funds

Unlock accrued fees

Family Offices

Unlock capital without selling growing private assets

Family Offices

Rebalance Portfolio

Family Offices

Bridging Capital Calls

Related case studies

GPs & Funds

Participate in play to play round

GPs & Funds

Bridge an LP anchor commit

Family Offices

Fuelling Investment Holding Company Growth with a NAV Facility

Family Offices

Wealth Transfer

Family Offices

Refinancing with a PIK-based facility

GPs & Funds

Unlock accrued fees

Family Offices

Unlock capital without selling growing private assets

Family Offices

Rebalance Portfolio

Family Offices

Bridging Capital Calls

London Office

Nodem Ltd

1a Britannia Street

London

United Kingdom

WC1X 9JT

Nodem Ltd is authorised and regulated by the Financial Conduct Authority, FRN 1017481. Company number 15661530. Nodem Ltd is registered in England and Wales under company number 15661530.

This website is for informational purposes only and does not constitute an offer, solicitation, or recommendation to sell or an offer to purchase any securities, investment products, or investment advisory services. This website and the information set forth herein are current as of 4 June 2025 and are not intended to provide investment recommendations or advice.

London Office

Nodem Ltd

1a Britannia Street

London

United Kingdom

WC1X 9JT

Nodem Ltd is authorised and regulated by the Financial Conduct Authority, FRN 1017481. Company number 15661530. Nodem Ltd is registered in England and Wales under company number 15661530.

This website is for informational purposes only and does not constitute an offer, solicitation, or recommendation to sell or an offer to purchase any securities, investment products, or investment advisory services. This website and the information set forth herein are current as of 4 June 2025 and are not intended to provide investment recommendations or advice.

London Office

Nodem Ltd

1a Britannia Street

London

United Kingdom

WC1X 9JT

Nodem Ltd is authorised and regulated by the Financial Conduct Authority, FRN 1017481. Company number 15661530. Nodem Ltd is registered in England and Wales under company number 15661530.

This website is for informational purposes only and does not constitute an offer, solicitation, or recommendation to sell or an offer to purchase any securities, investment products, or investment advisory services. This website and the information set forth herein are current as of 4 June 2025 and are not intended to provide investment recommendations or advice.